Update: Proposed SA Land Tax Changes Amended

Posted on 12/9/2019

Overview:

This week the State Government announced amendments to the proposed changes to SA Land Tax. The initial announcement of the proposed changes as part of the State Budget delivery back in June prompted feedback from both the property industry and the public. We discuss what this means for South Australian property owners and how the Team at Perks can help.

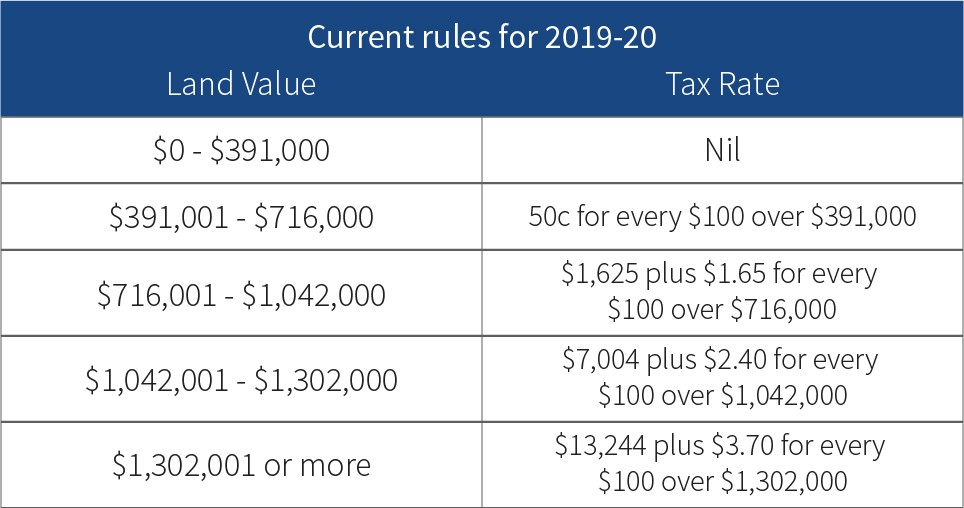

As part of the 2019 State Budget, which was handed down in June, the South Australian government announced significant changes to the state’s land tax regime.

Headlining the changes were amendments to the tax thresholds, a reduction in the top marginal rate and more rigorous land tax aggregation provisions, impacting property owners who hold land within trusts or companies.

Click here to read the full summary of the changes proposed as part of the 2019 State Budget.

Following feedback from the property industry and after further public consultation, the State Government yesterday announced that it had amended the proposal and put forward an updated land tax framework.

Significantly, the State Government has remained firm on its aggregation policy, which will stop investors from reducing their land tax liability by holding property assets in separate, related entities.

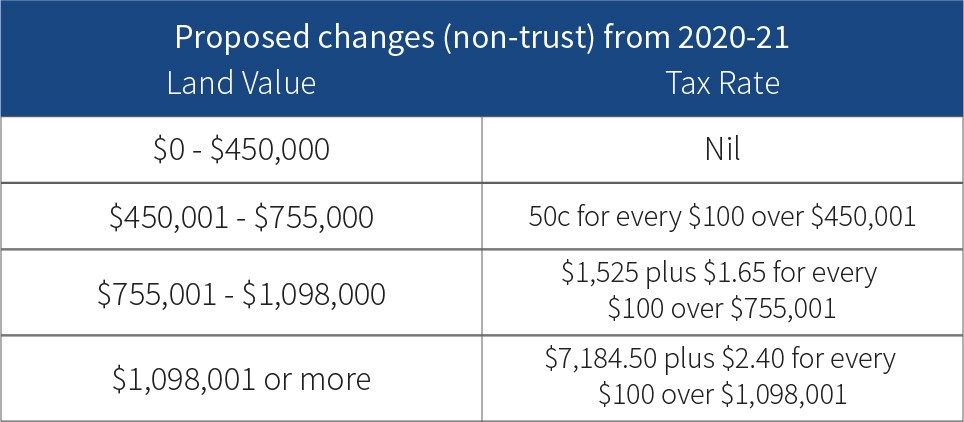

These changes will also see significant amendments to the land tax bracket thresholds that were proposed in the State Budget and a reduction in the top rate of land tax in SA from 3.7% to 2.4%. This will provide more substantial and immediate relief than the original proposal, which was for the top marginal rate to be gradually reduced from 3.7% to 2.9% over the next nine years.

As a result, the Government is set to wear a $70 million revenue hit when compared to its original proposal; however, it is a big win for individual investors, who will now pay land tax rates more in line with those in other States.

What the amended proposal means for you

Although every circumstance is different, large level investors with higher value land are set to be the biggest winners out of the amended proposal, while changes to the lower end tax threshold and top marginal rate will deliver a significant reduction in land tax liabilities for some property owners.

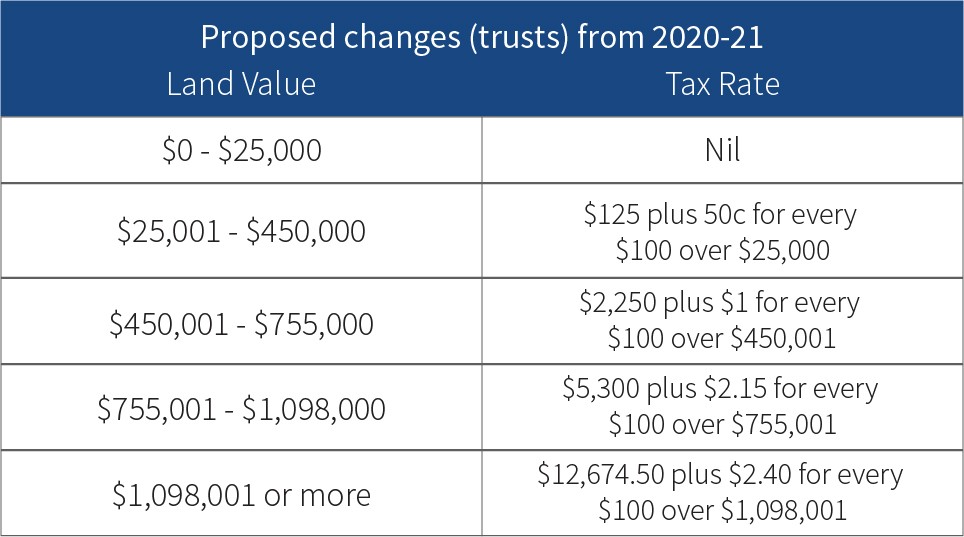

Under the proposal, non-trust held properties valued at up to $450,000 will incur no land tax, which is an increase from the current threshold of $391,000, while landholdings in trusts will incur a 0.5% surcharge on land value above $25,000 but below $1,098,000.

The threshold for the top marginal tax rate has been reduced from ~$1.3 million to ~$1.1 million; however, the rate is also set to be cut from 3.7% to 2.4%. These changes also see the State Government do away with its proposal to introduce a new top marginal tax threshold for properties or portfolios valued at more than $5 million in favor of an amended structure that is divided into separate streams – properties held by individuals or companies and properties held in trusts or companies – as outlined in the tables below.

Any questions? Speak to the experts at Perks.

We understand that the new land tax legislation may raise questions and we encourage you to reach out to the Perks Tax Consulting team who will be able to assist in answering your questions and consider potential restructuring options for you once the scope of these tax changes becomes clearer.

With the changes to undergo further public consultation and still to pass State Parliament, it’s important to note that there is still plenty of time for investors to look at their options and consider the benefits of a portfolio restructure.

Get in touch with Neil or Lee in Perks Tax Consulting Team:

Neil Oakes, Director – 08 8273 9320 NOakes@perks.com.au

Lee Jurga, Senior Tax Specialist – 08 8273 9248 LJurga@perks.com.au

Related insights.

Show Me The Perks Podcast | Land for Renewable Energy with Sam Richardson

24/2/2025

In this episode of Show Me The Perks, host Kim Bigg speaks with Sam Richardson, Director at...

Read more.

Show Me the Perks Podcast | Adelaide’s Property Market: Insights for SME’s and Investors

24/6/2024

In this episode, we dive into the Adelaide property market with insights from Ben Parkinson, Managing Director...

Read more.

How regulatory changes affect a SA property market bubble

12/10/2021

Banking & Finance

A booming SA housing market is tempered by restrictions on home lending to curb high risk borrowing.

Read more.

Want to receive our insights?

Sign up to receive important financial updates, useful tips, industry trends and whitepapers.