How regulatory changes affect a SA property market bubble

Posted on 12/10/2021

Banking & Finance

Overview:

Australia’s property market has surged since late 2020 with double digit growth seen across every state and territory and driven by South Australia. With such high demand, and with many buyers taking on large mortgages, regulators are becoming increasingly wary of the impacts that this property bubble is creating. In such circumstances there are real risks of both an affordability crisis and negative economic impacts if large numbers of people are unable to meet their repayment requirements. In response, APRA, Australia’s banking regulator moved to implement more stringent requirements for lenders in assessing the serviceability of home loans as of 31 October, 2021. Find out more about the changes and what they could mean for you below.

Investments, interest rates and a concerning debt-to-income ratio

Record growth in property prices across the country has resulted in increasing concerns among regulators about the ability of borrowers to repay large mortgages.

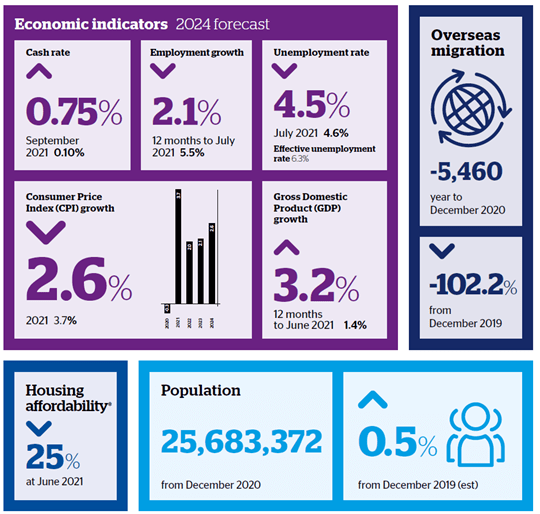

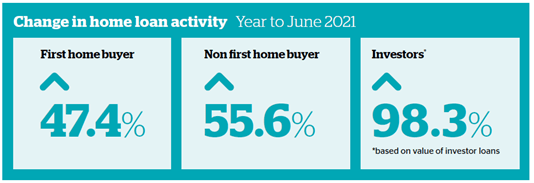

A combination of low interest rates, strong demand for housing, internal migration and an influx of expats and foreign investors have all fuelled this unprecedented demand.

The situation has also led to a significant increase in what can be described as ‘risky borrowing,’ with large numbers of people taking out mortgages significantly more than their annual income.

The difference between income and debt is known as the debt-to-income ratio and current levels across the country are of increasing concern to regulators. In fact, The Financial Review recently reported that more than one fifth of home buyers are borrowing more than six times their income. Furthermore, the number of new residential mortgages that are being taken out at or above this 6-to-1 debt-to-income ratio increasing to a record high of 22 per cent.

Higher interest rates a ‘double-edged sword’

While one strategy to cool the housing market would be raising interest rates, there is a hesitance from the Reserve Bank to go down this path due to the ongoing fragility of the nation’s economy.

There are also concerns that raising interest rates could potentially exacerbate the issue of high debt-to-income ratios and see more borrowers facing mortgage stress.

Equally, a rise in interest rates would likely result in a reduction in spending and instability in equity markets, which could all have negative economic effects.

While the Reserve Bank is responsible for interest rates and broader macroeconomic management, as Perks Finance Director Bruce Debenham pointed out, the more pertinent concern from APRA’s perspective is addressing excessive lending risk.

“APRA are less concerned with housing affordability as that really is the job of local law makers who oversee economic factors such as taxation, zoning and job creation,” Bruce said.

“However, what has become of concern to the regulator is the number of borrowers who are pushed to the affordability limit, which is where this double-edged sword consideration comes into around interest rates.

“In one sense, a rise in interest rates would likely lead to a cooling in house price growth, but also potentially exacerbates existing issues of mortgage affordability, which is the major issue that APRA is seeking to address.”

APRA announces stricter lending conditions

In response to these concerns about mortgage affordability, the banking regulator has now moved to impose stricter conditions on loan assessments that will come into effect from the end of October 2021.

Known as a macroprudential intervention, this change will see the minimum interest rate buffer on home loan applications increase from 2.5 to 3 percentage points.

What this means in practice is that banks, when making loan assessments, will need to ensure that a potential borrower could still afford their mortgage repayments if interest rates rose to be 3 percentage points above their current rate.

In announcing the changes, APRA Chair Wayne Byres said this is a targeted and judicious action designed to reinforce the stability of the financial system.

“In taking action, APRA is focused on ensuring the financial system remains safe, and that banks are lending to borrowers who can afford the level of debt they are taking on – both today and into the future,” he said.

“While the banking system is well capitalised and lending standards overall have held up, increases in the share of heavily indebted borrowers, and leverage in the household sector more broadly, mean that medium-term risks to financial stability are building.”

Impacts for prospective buyers and mortgage holders

What influence this will have on the property market will play out over the coming months and it is too early to speculate whether we will see a cooling in house prices, though this would be a logical inference.

While borrowers with an existing mortgage will not be directly impacted by these changes, Bruce said that the changes highlight market conditions that homeowners should be wary of.

“This announcement should serve as a wakeup call for borrowers and lenders alike. Any potential investor or borrower should ensure that they have the capacity to service their current loan now and for the next two to three years,” he said.

“It is as critical now as ever to seek advice to ensure you are getting the best interest rate available and that your banking facilities are best suited to your current circumstances.”

Perks Finance is a team of specialist banking and finance experts that research, compare and secure the best business, car, equipment or home loan facilities for your specific needs. They work and negotiate with lenders on your behalf, simplifying the lead time, process and administration necessary to secure the best loan and facilities.