December 2020 Quarterly Market Recap

Posted on 22/1/2021

Private Wealth

Overview:

COVID-19 vaccines, U.S. Election clarity and a Brexit deal vaulted markets through the final quarter of a remarkably unusual year. Despite the rollout of vaccines, a vicious new strain of the virus saw case numbers in many countries top previous peaks, particularly in the U.S. and Europe who saw a re-imposition of lockdowns in December. Trade tensions played out like elevator music throughout the background of 2020; bickering between the U.S. and China continued in the usual manner before China put Australia in its crosshairs, halting trade in wine, coal, barley, copper, sugar, timber, beef and lobster.

Key highlights:

- COVID-19 vaccine developers Pfizer, Moderna and Oxford-AstraZenaca lit the fuse on a supercharged November rally after their vaccines had between 90% and 95% efficacy. This launched the major global indexes into their best monthly returns in over 30 years, and for some, their best ever on record.

- Despite the Electoral College showing Biden at 306 and Trump at 232 (270 required to win), Trump launched a barrage of unsuccessful legal challenges in key battleground states demanding recounts and unsubstantiated claims of voter fraud. Although Trump refuses to concede, he has directed his administration to co-operate with the transition of power to the incoming Biden Administration.

- The UK has completed its 5-year divorce from the European Union as both sides ratified terms to the Brexit agreement on 24 December 2020, just days before the deadline and comes after 11 painstaking months of negotiations.

- The Federal Reserve after cutting rates twice in March, left the target funding rate unchanged (0%- 0.25%) for the balance of 2020. Instead, deploying its firepower in the form of highly accommodative policy settings such as bond purchasing schemes, the Paycheck Protection Program (JobKeeper equivalent), and adopting a long-term average inflation target of 2%.

- The RBA cut rates three times across the year, from 0.75% down to 0.10%, and in-line with the rest of the global central bank cohort, the RBA introduced a bond purchasing program alongside a target yield for shorter dated maturities on Government bonds. Further, it also established the Term Funding Facility (TFF) to support lending to Australian Businesses. The facility offered three-year funding to authorised deposit-taking institutions (e.g. Banks) with the end goal of reducing interest rates for borrowers (consumers).

- Sector* performance for the quarter: Australian Equities (+13.7%), Global Equities (+11.7%), Australian Fixed Income (-0.1%), Global Fixed Income (AUD Hedged) (+0.8%), AU Real Estate Investment Trusts (+13.2%). The Australian dollar rose from 0.72 U.S. cents across the quarter to finish at 0.77 U.S. cents (+7.4%).

*Australian Equities: S&P/ASX 200 TR, Global Equities: MSCI World ex Australia NR Index (AUD Hedged), Australian Fixed Income: Bloomberg AusBond Composite 0+ Year Index AUD Global Fixed Income: Bloomberg Barclays Global Aggregate TR Index (AUD Hedged), Australian Real Estate Investment Trusts: S&P/ASX 300 A-REIT TR Index AUD.

Other points of interest:

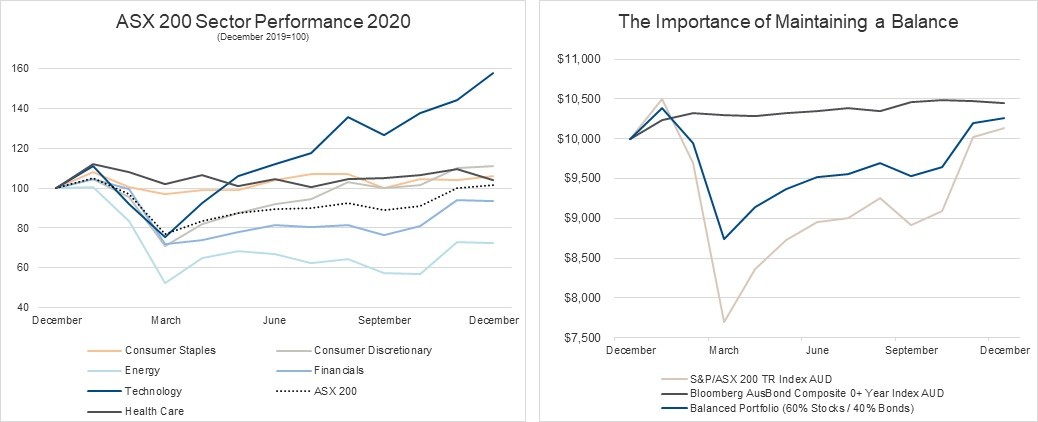

Locally on the ASX 200, the IT sector was the best performer for the calendar year, delivering a whopping (+57.8%) thanks to the shift to work from home and online retailing as consumers ditched credit cards for buy-now-pay-later merchants. The Materials sector (+18.2%) was a direct beneficiary of the iron ore price, which reached a 7-year high on strong Chinese demand and weaker Brazilian supply. The weakest sectors were Energy (-27.6%) as travel restrictions both domestically and internationally weighed on demand for oil. Industrials also felt the pinch from restrictions, sinking (-12.3%).

Prime Minister Scott Morrison declared Australia “should not be at the front of the queue” when it comes to vaccines given the relative success of Australia’s containment measures and more pressing need in other countries to achieve similar containment milestones. But as a stark reminder on the necessity to maintain hygiene and social distancing, NSW was put on high alert in December following an outbreak in Sydney’s Northern Beaches of the new more infectious strain of the virus, which has now also been identified throughout the country, including four cases in Victoria and one in Brisbane.

The latest unemployment figures (November) showed Australia’s recovery was continuing after 90,000 jobs were added (+5,800 part-time, +84,200 full time). A staggering 74,000 of these were added in Victoria and see’s the unemployment rate dip to 6.8%. Also part of the narrative in this data set was the participation rate, which surged to 66.1% – a previous record high. This strong surge limited the fall in unemployment rate and at this level, economist consensus is that it will facilitate unemployment to trend lower at a faster pace. Additionally, total hours worked in November jumped 2.5% and follows a 1.2% increase in October, meaning Australia can expect a benefit flow through into to the GDP reading for the fourth quarter. The latest RBA meeting minutes also noted the pace at which the Australian economy and labour market is recovering faster than previously anticipated.

Retail trade in November (latest) swelled by (+7.1%) month on month to a new record high, running around (+14%) higher than pre-COVID-19 levels. As observed in the employment data, it comes as no surprise to see a (+22.4%) lift in retail trade in Victoria, whilst South Australia saw a decline of (-0.2%) as a rapid lockdown was implemented. Clothing & footwear saw the biggest rises (+26.7%) along with department stores (+21.1%). Household goods rose a firm (+12.7%) to be placed back at previous peaks in the pandemic. The exception across all categories was food (-0.3%) as people continued to dine out (+6.7%), the dinning out category is the only one to lag on pre-COVID levels. Overall, with the inability for consumers to travel abroad (and domestically), coupled with the Christmas Holiday period, there has been a distinct shift to spending on goods rather than services.

The U.S. labour market key indicator, non-farm payrolls, dragged its heels through years end with disappointing figures that were the weakest in six-months. The weakness sent a clear message to lawmakers that a bi-partisan fiscal stimulus deal would be required to avoid further negative momentum in the jobs market (ex-warehousing and transport sectors). The $900bn stimulus deal passed late December was described by President-elect Biden as a “down payment” and is expected to call on congress to pass additional measures after his inauguration on 20 January 2021. These would largely take shape in more direct payments (~ USD$2000 stimulus check instead of the recent USD$600), as well as aid to cities and states to assist with containment efforts in the fight against COVID-19. Economists have noted the ballooning US fiscal deficit is indeed expected to put further downward pressure on the U.S. dollar through 2021, subsequently supporting commodity prices like iron ore and gold (and the Australian dollar).

For Commodities, the price of Oil (Crude) remains at the mercy of weak demand and a bubbling supply. However, vaccine rollouts and a pledge from Saudi Arabia to cut an additional 1 million barrels per day on top of pre-existing OPEC requirements saw a rally across November and December. OPEC (Organization of the Petroleum Exporting Countries) has had a turbulent year, with some members threatening to not adhere to production quotas and even depart from the group. Pleasingly, there was evidently some Christmas spirit found in the last meeting for the year, with the group agreeing to hold production steady in the face of new coronavirus lockdown restrictions from consumption-heavy countries. Australian iron ore producers enjoyed a bountiful quarter with the commodity hitting 7-year highs after Brazilian competitor Vale cut its guidance on exports. Vale has struggled to get back to full operational capacity as it contends with the lingering impacts of dam-related closures in 2019 and ongoing lockdown orders. Supply was further crimped by La Nina weather systems around Port Headland. Chinese demand also exhibited no signs of slowing despite the seasonal winter shutdown; imports were up (+8.3%) in November (latest) bringing the years total to over 1 billion tonnes. Baked into this sheer quantity (in year on year terms), industrial production rose (+7%), property investment saw (6.7%) growth and fixed asset (infrastructure) saw (+2.6%).

For the Fixed Income sector, both U.S. Treasury’s and Australian Government Bonds (10-year maturities) continued their march towards 1.0% across the quarter. The Australian 10-year rose by 7bps to (0.97%) in December, ending the year discreetly ahead of the U.S 10-year which finished at (0.92%). The conundrum of the bond market for 2020 is expected to continue into 2021; equity markets are ripping ever higher on continued stimulus hopes, vaccine rollouts and U.S. political clarity, whilst investors are seemingly ignoring economies that remain in a weakened position compared to pre-pandemic levels, particularly with the near-to-medium term outlook for those facing the stark reality of further deterioration before improvement in containment of COVID-19.

As always, the narrative behind the importance of maintaining a well-diversified portfolio remains steadfast when volatility, uncertainty and ambiguity are on the horizon.

Related insights.

Perks Welcomes New Directors to its Group Board

8/1/2024

Original Article: September 2023

We welcome two new members to the Perks Group Board and look forward to them making a...

Read more.

Show Me the Perks Podcast | From Nest to Nest Egg: A guide to the First Home Super Saver Scheme

28/11/2023

In this third instalment of Show Me The Perks, our host Kim Bigg chats to Sam Wagner,...

Read more.

Show Me the Perks Podcast | The $3 Million Super Tax: Will it affect me?

10/11/2023

In the latest episode of Show Me The Perks, Kim Bigg, sits down with the Simon Wotherspoon,...

Read more.

Want to receive our insights?

Sign up to receive important financial updates, useful tips, industry trends and whitepapers.