As the Federal Government attempts to lift Australia of recession, this year’s budget extended the unprecedented COVID-19 spending spree by delivering further tax cuts, cash payments and wage subsidies.

Emphasising government rhetoric of the past few months, the Treasurer delivered a budget that he claims will keep people in jobs, create new jobs and drive economic recovery through private sector investment.

The headline news

The big news out of the budget is the Government’s focus on incentivising private sector investment, which has been widely viewed as a win for business. With around 80 per cent of Australians employed in the private sector, the government is confident the new budget measures will lead private business investment by delivering cash flow relief and incentives to create new jobs and increase spending.

In fact, the Treasurer has set the ambitious goal of creating 950,000 new jobs over the next four years, which will be underpinned by the $74 billion JobMaker plan. By the time all is said and done, the Government will have spent around $507 billion to fuel Australia’s economic recovery. However, it will come at a heavy cost. National debt is set to rise over the next four years, from $872 billion in 2020-21 to a peak of $1.1 trillion in 2023-24.

While there is a lot to digest from a wide range of sources, four key aspects of the budget will be of particular note for our clients:

- JobMaker hiring credit and carry back of losses

- Expedited personal income tax cuts

- Broadening of the instant asset write-off scheme

- Simplified fringe benefits tax regime

It’s a bold plan but a clear roadmap to recovery and Mr Frydenberg said it represents “the largest set of investment incentives any Australian government has ever provided.”

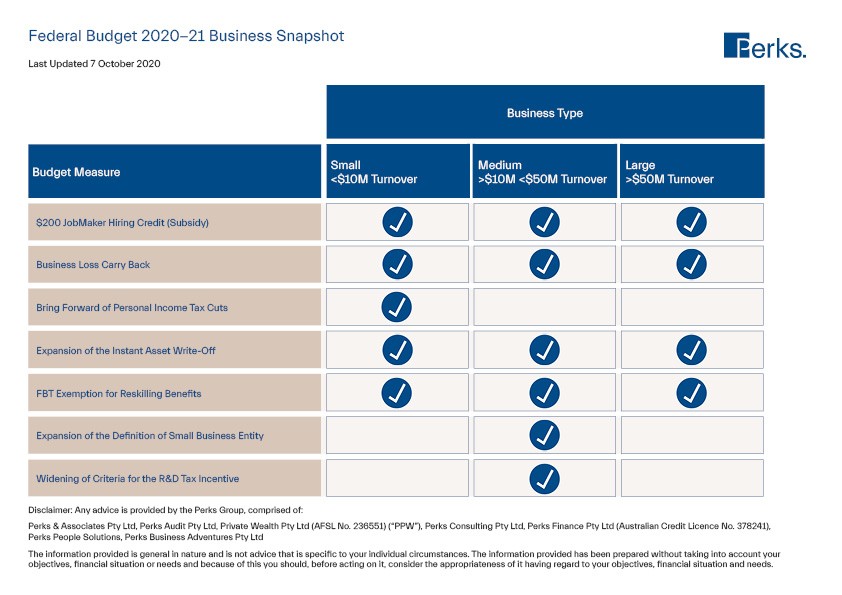

Click here for a printable version of the table, above.

Introduction of a JobMaker plan

JobKeeper, JobSeeker and now JobMaker. The Federal Government has furthered incentivised private business to create new jobs and keep people employed with a new plan focussed on providing businesses with credit and cash flow support to do so.

The $74 billion plan is broad and encompasses many key budget measures, including providing businesses with cash credits for hiring young people, an extension of the instant asset write-off scheme and the fast-tracking of personal tax cuts.

JobMaker hiring credit

From as soon as today, businesses who hire an individual under the age of 35 will be provided with a subsidy of up to $200 per week, per new employee for the next 12 months under a $4 billion wage subsidy scheme designed to create around 450,000 jobs.

The hiring credit is available to all registered Australian businesses, which will receive $200 per week for every new hire aged between 16 and 29 and $100 per week for every new hire aged between 30 and 35.

Employers will claim the credit quarterly in arrears from the ATO from February 1, 2021. To qualify, the new hire must have also worked at least an average of 20 hours per week over the quarter and have been receiving JobSeeker, Youth Allowance or parenting payment for at least one of the previous three months before being hired.

Another measure that was announced in the lead-up and is also worth mentioning is the $1.2 billion new apprentice and trainee scheme. Under this scheme, employers will receive a 50 per cent subsidy (up to $7000 per quarter) for wages paid to new apprentices or trainees until September 2021.

Business losses can now be carried back

The Government will now allow eligible companies to offset losses from 2019-20 to June 2022 against previously taxed profits in or after the 2018-19 financial year, in what will be a big boost to COVID-impacted businesses.

Companies with an aggregated turnover of less than $5 billion can apply losses against taxed profits in a previous year, generating a refundable tax offset in the year in which the loss is made.

The tax refund will be available to businesses when they lodge their 2020-21 and 2021-22 tax returns.

Currently, companies are required to carry losses forward to offset profits in future years. Businesses can also elect to not carry back losses under this measure and can still carry losses forward as normal.

Expedited personal income tax cuts

Perhaps the biggest news for individuals out of the budget is the announcement that it will bring forward the second stage of its Personal Income Tax Plan by two years and retain the low and middle income tax offset (LMITO) for 2020-21, which made its debut last year.

Originally slated for 1 July 2022, the second stage of the Personal Income Tax Plan now comes into effect retrospectively from 1 July 2020.

The Plan includes the following measures:

- The top threshold of the 32.5 per cent personal income tax bracket will increase from $90,000 to $120,000.

- The top threshold of the 19 per cent personal income tax bracket will increase from $37,000 to $45,000.

- The low income tax offset (LITO) will increase from $445 to $700. The increased LITO will be withdrawn at a rate of 5 cents per dollar between taxable incomes of $37,500 and $45,000. The LITO will then be withdrawn at a rate of 1.5 cents per dollar between taxable incomes of $45,000 and $66,667.

The measures will be backdated to take effect from 1 July 2020 and will be first reflected in personal tax returns lodged for the 2020-21 financial year.

As was the case under the previous arrangement, the LMITO will continue to provide a reduction in tax of up to $1,080 for individuals. It equates a reduction in tax of up to $255 for taxpayers with a taxable income of $37,000 or less. Between taxable incomes of $37,000 and $48,000, the value of the offset increases at a rate of 7.5 cents per dollar to the maximum offset of $1,080. Taxpayers with taxable incomes between $48,000 and $90,000 are eligible for the maximum offset of $1,080 and, for taxable incomes of $90,000 to $126,000, the offset phases out at a rate of 3 cents per dollar.

Under these new personal income tax arrangements, an individual earning $120,000 per year will be better of by more than $2700 in 2020-21 when compared with 2017-18. For someone earning $200,000 per year, this amount is $2565 and for an individual earning $80,000, it’s $2160.

Broadening of the instant asset write-off scheme

The Government will support businesses with aggregated annual turnover of less than $5 billion by enabling them to deduct the full cost of eligible capital assets acquired from 7pm on budget night, provided the asset is first used or installed by 30 June 2022.

This new measure is effectively an extension of the existing scheme, which enabled business to write off eligible purchases of up to $150,000 and was due to expire on 31 December 2020. It is designed to improve cash flow for businesses that purchase eligible assets and bring forward new investment to support the economic recovery.

Importantly, for small and medium sized businesses with aggregated annual turnover of less than $50 million, the instant asset write-off also applies to the purchase of second-hand assets.

Businesses with aggregated annual turnover between $50 million and $500 million can still deduct the full cost of eligible second-hand assets costing less than $150,000 that are purchased by 31 December 2020 under the enhanced instant asset write-off. These businesses will now also have until 30 June 2021 to first use or install those assets.

Simplified fringe benefits tax regime

The Government will introduce an exemption from the 47 per cent fringe benefits tax (FBT) for employers who provide retraining or reskilling to employees who have been, or are soon to be, made redundant where that training is not sufficiently connected to their current employment.

Currently, FBT is payable if an employer provides this training to redundant or soon to be redundant employees. This measure will provide an FBT exemption for a broader range of retraining and reskilling benefits, incentivising employers to retrain redundant employees to prepare them for their next career.

The exemption will not extend to retraining acquired by way of a salary packaging arrangement. It will also not be available for Commonwealth supported places at universities, which already receive a benefit, or extend to repayments towards Commonwealth student loans.

As part of this effort to simply FBT, the Government will also allow employers to rely on existing corporate records, rather than employee declarations and other prescribed records, to finalise their FBT returns. The measure will have effect from the start of the first FBT year (1 April) after the legislation is passed.

The measure will remove the need for employers to complete additional records, reducing compliance costs, while maintaining the integrity of the FBT system.

Other key budget measures

Additional funding to address serious and organised crime in the tax and superannuation system

The Government will provide $15.1 million to the Australian Taxation Office (ATO) to target serious and organised crime in the tax and superannuation systems. This extends the 2017-18 Budget measure Additional funding for addressing serious and organised crime in the tax system by a further two years to 30 June 2023.

Clarifying the corporate residency test

The Government will make technical amendments to clarify the corporate residency test. The Government will amend the law to provide that a company that is incorporated offshore will be treated as an Australian tax resident if it has a ‘significant economic connection to Australia’. This test will be satisfied where both the company’s core commercial activities are undertaken in Australia and its central management and control is in Australia.

Research and development

The Government will make further enhancements to the 2019-20 MYEFO measure Better targeting the research and development tax incentive — refinements to support business Research and Development (R&D) investment in Australia and help businesses manage the economic impacts of the COVID-19 pandemic.

Granny flats exempt from capital gains tax

The Government will provide a targeted capital gains tax (CGT) exemption for granny flat arrangements where there is a formal written agreement. The exemption will apply to arrangements with older Australians or those with a disability. The measure will have effect from the first income year after the legislation is passed.

Increases to the small business entity turnover threshold

The Government will expand access to a range of small business tax concessions by increasing the small business entity turnover threshold for these concessions from $10 million to $50 million as follows:

- From 1 July 2020, eligible businesses will be able to immediately deduct certain start-up expenses and certain prepaid expenditure.

- From 1 April 2021, eligible businesses will be exempt from the 47 per cent fringe benefits tax on car parking and multiple work-related portable electronic devices (such as phones or laptops) provided to employees.

- From 1 July 2021, eligible businesses will be able to access the simplified trading stock rules, remit pay as you go (PAYG) instalments based on GDP adjusted notional tax, and settle excise duty and excise-equivalent customs duty monthly on eligible goods under the small business entity concession. Eligible businesses will also have a two-year amendment period apply to income tax assessments for income years starting from 1 July 2021, excluding entities that have significant international tax dealings or particularly complex affairs.

For more information of this year’s budget or to discuss how these new measures may impact you, contact your trusted Perks adviser today.