What’s new in Super for 2019

Posted on 14/11/2019

Overview:

Keeping track of legislative changes to superannuation can be a tricky task! A new work test exemption and the ability to claim unused contributions in future years headline the latest changes to Australian superannuation law that could have an impact on your lifestyle in retirement. We've outlined how you could leverage both below when preparing for life after work.

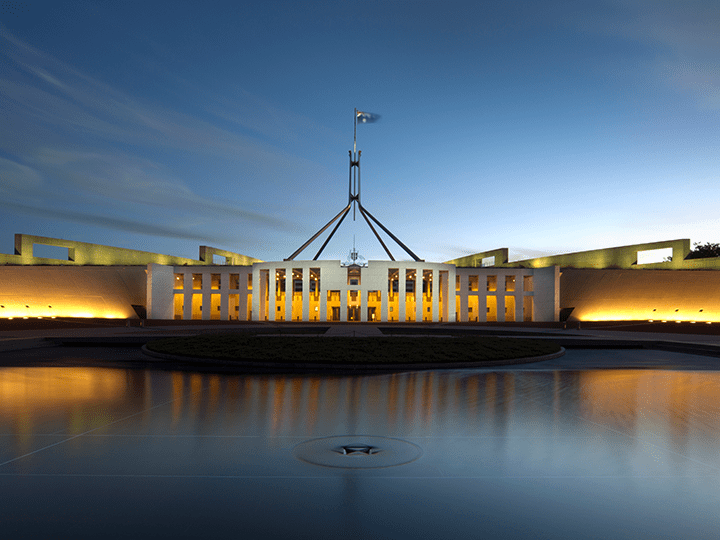

In recent years, the topic of superannuation has become something of a political football. It’s continually seized upon and debated by all sides of politics to the point that it can be difficult to keep up with the latest rules and legislation governing Australia’s retirement income model.

While some changes – such as the Tax Office’s recent decisions to return money from inactive super accounts and remove compulsory life insurance from low balance accounts and those held by under 25s – have garnered a significant amount of media coverage, others have received precious little attention.

Although the system continues to operate in fundamentally in the same manner it has for since 2007, some of these recent changes, which we will look at in this article, could have significant implications for your lifestyle in retirement.

The work test exemption

On top of the compulsory 9.5% contribution your employer must make to your superannuation each year, you are eligible to make a personal contribution that can be claimed as a deduction from your taxable income (also known as a concessional contribution) to take your total concessional contributions up to $25,000 per annum.

In order to claim this concessional contribution deduction, you are required to satisfy several criteria, one of which is the work test. While this test does not apply to anyone under the age of 65, those aged 65-74 to were previously required to prove that they worked 40 hours during a consecutive 30-day period in each financial year where they make super contributions.

However, commencing from 1 July 2019, new legislation has been introduced that will exempt some recent retirees from the work test. In order to qualify for this new exemption, you must:

- be aged between 65-74,

- have satisfied the work test in the preceding year,

- have a total super balance of less than $300,000 at the end of the previous financial year and

- not have previously used the work test exemption.

Whether you’re recently retired or planning on retiring soon, this new legislation affords the opportunity to access a significant one-off tax benefit that is worth considering as part of your future planning.

Catching-up on concessional contributions

As mentioned above, each year, you may be eligible to make a $25,000 concessional contribution to your super fund that can be claimed as a deduction from your taxable income.

In a further change to the rules governing concessional contributions, the Tax Office is now allowing people to make additional concessional contributions above the $25,000 cap to effectively catch-up on years (any financial year commencing from 1 July 2018) where they have contributed less than the $25,000 cap.

For example, a person who made a $15,000 concessional contribution to their superannuation in 2018-19 would be eligible to claim up to $35,000 ($25,000 concessional cap + $10,000 unused amount) as a concessional contribution and subsequent deduction from their taxable income for any of the next five years (commencing from the 2019-20 financial year), after which time any unused amounts expire.

Perks Private Wealth Director, Peta Nunn points out that these catch-up payments could be particularly useful in circumstances where an individual anticipates a significant increase in their taxable income over the next five years.

“It could allow you to maximise your superannuation contributions while minimising your tax liability over an extended period,” says Peta.

It is also important to note that in order to be eligible, your total super balance must be less than $500,000 at the beginning of the financial year in which you intend to make a catch-up concessional payment.

Don’t get confused by the noise

With constant debate around superannuation in parliament and the media, it can be difficult to keep up with the latest reforms and legislative changes. In fact, in recent years, many proposals and bills have been introduced which have since lapsed or have disappeared altogether.

Peta maintains the imperative for all working Australians and those nearing the end of their working lives is to have a sound strategy in place for retirement.

“While new changes to legislation may require slight adjustments to your individual superannuation strategy, a solid plan and the right advice will ensure you can enjoy the lifestyle you want in retirement.”

Related insights.

Show Me The Perks Podcast | Navigating the $3 Million Super Tax

5/6/2025

In this episode of Show Me The Perks, host Kim Bigg is joined by Peter Burgess, CEO...

Read more.

Show Me the Perks Podcast | The $3 Million Super Tax: Will it affect me?

10/11/2023

In the latest episode of Show Me The Perks, Kim Bigg, sits down with the Simon Wotherspoon,...

Read more.

2023-24 Federal Budget Summary

11/5/2023

Tax

The 2023-24 Federal Budget was delivered by Treasurer Jim Chalmers this week. As more detail is released...

Read more.

Want to receive our insights?

Sign up to receive important financial updates, useful tips, industry trends and whitepapers.