UPDATED: Stimulus Package Highlights for Business

Posted on 24/3/2020

Business Advisory

Overview:

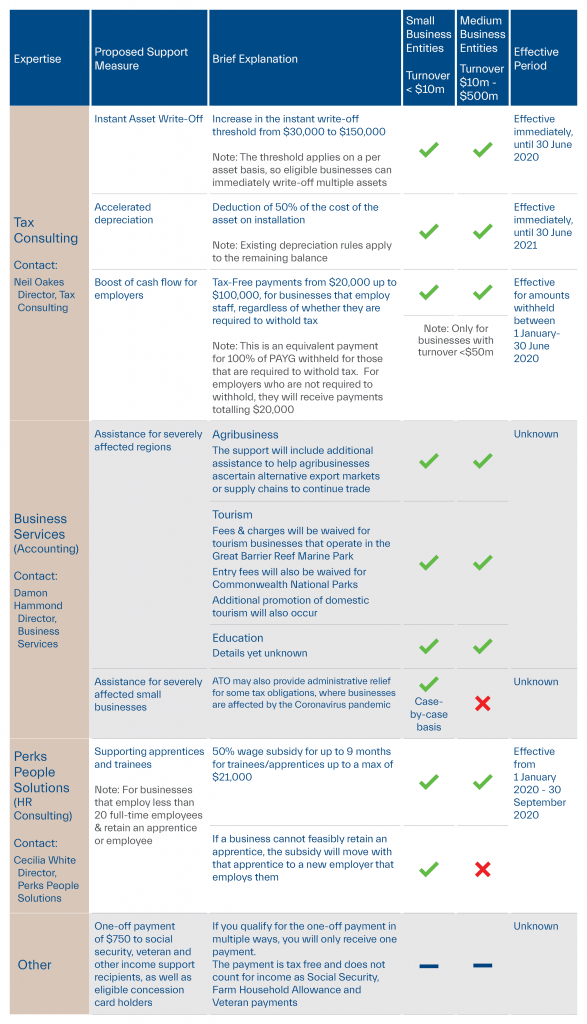

As you may be aware, the Federal Government has now announced a second round of stimulus/ survival measures on top of those previously announced on 12 March. We’ve summarised all the proposed changes below that may be able to support your business. The total Federal Government package now represents $189B in economic initiatives and aims to prevent a significant slowdown in economic activity.

Businesses Support

Boosting Cash Flow for Employers

Expanding on one of the prior initiatives, eligible small and medium-sized businesses (including Not For Profits) that employ people will receive cash payments totaling $20,000 – $100,000. Eligibility is as follows:

- An aggregated annual turnover under $50M; and

- Be an employer.

Employers will now receive a payment equal to 100% of the tax on their salary and wages withheld (up from the previously announced 50%), with the maximum payment being increased from $25,000 to $50,000. In addition, the minimum payment is being increased from $2,000 to $10,000.

An additional payment is also being introduced in the July – October 2020 quarter. Eligible entities will receive an additional payment equal to the total of all of the “Cash Flow Boost ” payments they have received.

In essence, this means that eligible entities will receive at least $20,000 up to a total of $100,000 under both payments (i.e. the initial payment is doubled). Employers who do not have withholding requirements but nonetheless have employees will receive payments totaling $20,000.

The cash payments are automated as they take the form of a credit in the activity statement system.

Example:

Sarah’s Construction Business Sarah owns and runs a building business in South Australia and employs 8 construction workers on average full-time weekly earnings, who each earn $89,730 per year. Sarah reports withholding of $15,008 for her employees on each of her monthly Business Activity Statements (BAS).

Under the Government’s changes, Sarah will be eligible to receive the payment on lodgement of her BAS. Sarah’s business receives:

- A credit of $45,024 for the March period, equal to 300 per cent of her total withholding.

- A credit of $4,976 for the April period, before she reaches the $50,000 cap.

- No payment for the May period, as she has now reached the $50,000 cap.

- An additional payment of $12,500 for the June period, equal to 25 per cent of her total Boosting Cash Flow for Employers payments.

- An additional payment of $12,500 for the July period, equal to 25 per cent of her total Boosting Cash Flow for Employers payments.

- An additional payment of $12,500 for the August period, equal to 25 per cent of her total Boosting Cash Flow for Employers payments.

- An additional payment of $12,500 for the September period, equal to 25 per cent of her total Boosting Cash Flow for Employers payments.

Under the previously announced Boosting Cash Flow for Employers measure, Sarah’s business would have received a maximum payment of $25,000.

Under the Government’s enhanced Boosting Cash Flow for Employers measure, Sarah’s business will receive $100,000. This is an additional $75,000 to support her business and help her retain her staff.

Temporary relief for financially distressed businesses

The Government is temporarily:

- Increasing the threshold at which creditors can issue a statutory demand on a company from $2,000 to $20,000.

- Increasing the threshold at which creditors can initiate bankrupt proceedings against an individual from $5,000 to $20,000.

- Increasing the time companies and individuals have to respond to statutory demands they receive from 21 days to 6 months.

- Relieving directors from any personal liability for trading while insolvent.

- Providing flexibility in the Corporations Act 2001 for targeted relief from unforeseen events that arise as a result of the Coronavirus health crisis.

The ATO will work with businesses that are currently struggling due to the Coronavirus, including temporary reduction of payments or deferrals, or withholding enforcement actions including Director Penalty Notices and wind-ups.

Support for Affected Areas & Businesses

The Government will set aside $1B to support regions most significantly affected by the Coronavirus outbreak.

The Government is also assisting the airline industry by providing relief from a number of taxes and Government charges (a $715M package).

Instant Write-off on Plant & Equipment

Currently, the instant asset write-off threshold is $30,000 per asset and the eligible turnover threshold is $50M.

From the date of the announcement until 30 June 2020, businesses with an aggregated turnover of less than $500M can immediately write-off the cost of an asset where the cost of the asset is $150,000 or less.

The threshold applies on a per asset basis, so eligible businesses can immediately write-off more than one asset acquired during the remainder of the financial year (prior to 30 June 2020).

For businesses with a small business entity depreciation pool that has a pool balance of $150,000 or less at the end of the financial year, the entire pool balance may be written off (deducted).

Example:

Mr MacDonald runs a farm in the South East with a prior year turnover of $4M. Mr MacDonald’s business acquires a new header unit for $85,000. Under the current rules, as the asset’s cost exceeds $30,000, Mr MacDonald is required to deduct (depreciate) the new header unit over its effective life under either the diminishing value or straight-line method. Where Mr MacDonald acquires the new header unit between 12 March 2020 and 30 June 2020, Mr MacDonald may claim an instant deduction equal to 100% of the unit’s cost.

50% Write-off on Plant & Equipment

Businesses with an aggregated turnover of less than $500M will be able to write-off 50% of the cost of a new eligible asset (once installed ready for use), with existing depreciation rules applying to the balance of the asset’s cost.

The initiative is limited to a 15-month period from the date of announcement through to 30 June 2021.

Given the instant asset write-off discussed above, this initiative will apply to assets with a cost exceeding $150,000 until 30 June 2020 and to assets over $30,000 in the 2021 financial year.

Example:

Assume Mr MacDonald also buys a truck & trailer for $200,000. Under the current rules, as the asset’s cost exceeds $30,000, Mr MacDonald is required to deduct (depreciate) the truck & trailer over its effective life under either the diminishing value or straight-line method. Where Mr MacDonald acquires the truck & trailer between 12 March 2020 and 30 June 2020, Mr MacDonald may claim an up-front 50% deduction ($100,000) as the truck & trailer’s cost exceeds $150,000. The remaining $100,000 in written down value is claimed under the normal depreciation rules.

Apprentices and Trainees

Small businesses employing less than 20 full-time employees can apply for a wage subsidy equal to 50% of an apprentice’s or trainee’s wage paid for up to 9 months (from 1 January 2020 to 30 September 2020). The subsidy is limited to $21,000 per apprentice/trainee.

If a small business is not able to retain the apprentice, the subsidy will be available for any new employer that employs that apprentice.

Credit and Lending

SME Lending Support

SMEs with a turnover of up to $50M will be eligible to receive loans partially guaranteed by the Government. The Government will provide eligible lenders with a 50% guarantee for loans with the following terms:

- Up to $250,000 per borrower.

- Up to three years, with an initial six month repayment holiday.

- Unsecured finance, meaning that borrowers will not have to provide an asset as security for the loan.

- The Government will encourage financiers to only charge interest on any amounts drawn down from the loan.

The scheme will commence early April 2020 and be available for new loans made by participating lenders until 30 September 2020.

Credit for Small Business

Lenders will receive a temporary exemption from responsible lending obligations in providing credit to existing small business customers. This reform will help small businesses get access to credit quickly and efficiently (including new credit, credit limit increases and credit variations and restructures).

RBA Initiatives

The RBA announced a package on 19 March 2020 that will put downward pressure on borrowing costs for households and businesses.

The RBA announced a term funding facility for the banking system. Banks will have access to at least $90B in funding at a fixed interest rate of 0.25%. This will reinforce the benefits of a lower cash rate by reducing funding costs for banks, which in turn will help reduce interest rates for borrowers. To encourage lending to businesses, the facility offers additional low-cost funding to banks if they expand their business lending, with particular incentives applying to new loans to SMEs.

In addition, the RBA announced a further easing in monetary policy by reducing the cash rate to 0.25 per cent. It is also extending and complementing the interest rate cut by taking active steps to target a 0.25% yield on 3-year Australian Government Securities.

Non-ADI and Smaller ADI Lenders in the Securitisation Market

The Government is providing the Australian Office of Financial Management with $15B to invest in structured finance markets used by smaller lenders, including non-Authorised Deposit-Taking Institutions and smaller Authorised Deposit-Taking Institutions. This support will be provided by making direct investments in primary market securitisations by these lenders and in warehouse facilities.

APRA Initiatives

APRA has announced temporary changes to its expectations regarding bank capital ratios. The changes will support banks’ lending to customers, particularly if they wish to take advantage of the new facility being offered by the RBA.

Implementation and Timing

A package of Bills is being introduced into Parliament on 23 March 2020 for urgent consideration. Subject to passage of the Bills through Parliament, the Government will then move to immediately make, and register, supporting instruments.

Looking for the latest on the proposed Government Stimulus Package for Individuals and Households? Click Here

Related insights.

ATO Interest Charges Deduction Removed from July 2025

4/7/2025

Updated July 2025- Tax Advisory

Effective 1 July 2025, the Australian Taxation Office (ATO) will no longer allow taxpayers to claim a...

Read more.

EOFY 2025: Essential Tax Planning Tips for Private Business Owners

5/5/2025

Updated June 2024 - Tax Advisory

With the end of financial year fast approaching, there are key considerations for the current 2024-25 tax...

Read more.

S.A. State Government On-Farm Drought Infrastructure Rebate Scheme Now Open

24/4/2025

Agribusiness

S.A. primary producers can now access up to $20k through the On-Farm Drought Infrastructure Rebate Scheme. Learn...

Read more.

Want to receive our insights?

Sign up to receive important financial updates, useful tips, industry trends and whitepapers.