Three-tier approach to retirement

Posted on 15/7/2020

Private Wealth

Overview:

Running out of money in retirement is one of the biggest worries for retirees. A disciplined savings and investment strategy over your working years determines how much you accumulate. Yet it’s equally important how and where you allocate your assets during your retired years.

If you have ample capital, you can afford to take more risks via a longer-term investment focus. However, if you need to draw more from your portfolio than its interest and dividends provide, then you consequently must consume your capital over time. In that circumstance, you ought to take less risk. A large market correction in your first years of retirement like the COVID dip, can significantly affect how long your retirement savings last.

It’s an effect commonly called ‘sequencing risk’. Average returns or better in your first decade of retirement gives your capital a better chance of outlasting you than if you experience below average returns in those early years. Unfortunately, accumulating enough capital and drawing commensurate income is just part of an investor’s challenge.

Carefully structuring your investments for reliable retirement income allows you to stay the journey when your long-term investments fluctuate in value. Wealth can easily be destroyed by panic selling at a bad time. With your Perks adviser, you might consider an underlying ‘three tier’ philosophy to construct your retirement portfolio. It offers reliable income while encouraging the patience to stay the course when your long-term growth investment values fluctuate.

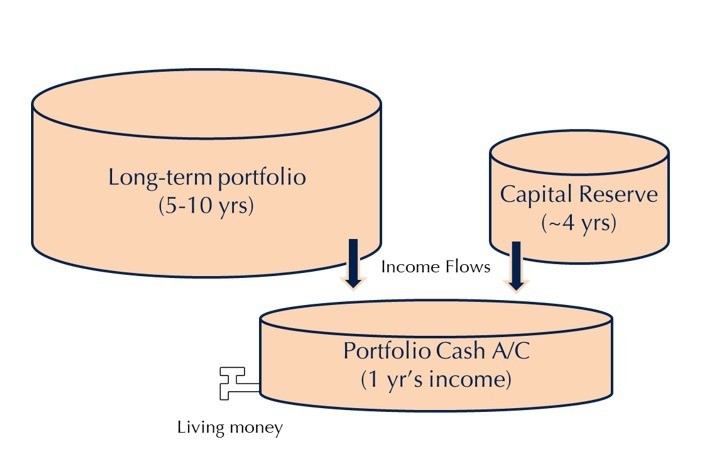

Essentially, this ‘three-tier approach’ allocates at least 4-5 years of your income needs to capital stable, income-producing investments while holding the rest in long-term capital growth investments so they can remain untouched long enough to perform well for you.

The three-tiered retirement portfolio approach:

The amount held in each tier depends on how much retirement capital you have, how much you need for annual living costs and your tolerance to investment risk. In normal and bullish markets, income would flow as shown in the diagram with top-ups taken as profit from the long-term portfolio (tier 3).

Then when markets turn negative, the long-term portfolio can be left untouched and any top-up income you need can be met by drawing down on capital reserves (tier 2). This protects your long-term assets until the market recovers.

It may even be prudent to use some capital reserves to add to the long term portfolio at times when prices are extraordinarily low. This all takes courage but having capital reserves makes such courage easier to find. It’s also a time where a good adviser can add significant value.

Tier 1: Short Term Liquidity (Portfolio Cash)

Set aside your short term spending needs (for 1 year) as liquid cash in a portfolio account and draw your regular income from here. It’s usually a monthly direct credit into your daily living account (like a regular salary). This portfolio cash account acts as your central cash hub, into which all investment income from the rest of the portfolio is deposited. These deposits regularly replenish the account after living cost withdrawals.

If your spending exceeds in-flowing portfolio income, top-ups can be made by drawing on capital reserves or taking profit from well-performing assets held in tier 3.

Tier 2: Capital Reserves

This is a reliable top-up reserve from which to replenish your Tier 1 cash. It should hold at least 4 years of ‘top-up’ amounts to ensure your long-term portfolio can last at least 5 years (1+4) before any growth-oriented investments need to be redeemed. That ‘elbow room’ allows longer-term growth investments time to recover from market dips along the way. Consequently, any selling is done at more ‘opportune’ prices to minimise self-destructive, emotional investment decisions.

These capital reserves should be invested in capital stable assets like term deposits, bonds and interest bearing securities. Essentially, assets that don’t fluctuate in value much over a year or so, meanwhile earning enough to buffer against inflation. Their purpose is capital reliability rather than high returns – both would be good, yet unlikely.

When your portfolio cash needs replenishing (if withdrawals exceed income flows), redeem capital reserve investments to replenish it. Restore your Capital Reserves in times of plenty.

Tier 3: Long-term Portfolio

Invest the rest of your capital for the longer term (5 years or more) in growth-oriented investments. These include shares, property and infrastructure assets, which offer historically higher longer term returns but can fluctuate in value along the way.

Growth assets play an important role for most retirees as they usually grow your capital as well as provide income. This is vital to help your capital last over your retired years. Some cash and fixed interest investments can also be held here, depending on your risk/return preference and market circumstances.

Three-tier advantage?

This tiered approach can give you peace of mind and more investing predictability with a clearer overall retirement picture. It allows you to stay the course and manage your emotions during times of financial drought. It can overlay your portfolio asset allocation strategy and complement your personal circumstances.

Obviously, the strategy relies on accurate assessment of your sustainable retirement expenses. It also relies on your overall portfolio asset allocation being able to generate the required return to match your retirement needs.

Regularly re-assessing your portfolio’s income capacity against your income needs during your retired years can also add significant value, clarifying opportunity and avoiding nasty surprises.