The Year in Review: 2019/20 Market Commentary

Posted on 12/8/2020

Private Wealth

Overview:

Whichever way history describes the financial year, 2020 will live long in our memories. First, as a devastating health crisis and second for the massive impact virus containment had on the real economy and investment markets.

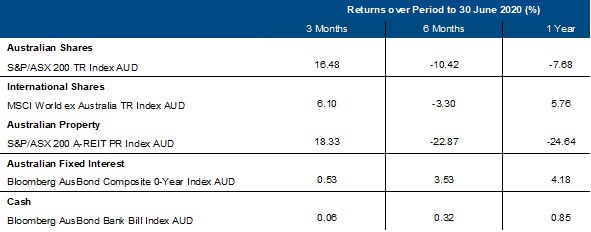

Index returns as at 30 June 2020

Market Overview

For investment markets, it was a year of two halves. The first half of the year produced strong results for most growth assets, peaking around 20 February 2020. But as the severity of COVID-19 became clear, markets entered one of the fastest bear markets in history, sending Aussie shares down 37% by 23 March 2020. Credit markets seized up, causing short-term losses on some fixed interest exposures and managed funds and super funds alike saw large capital outflows as investors scrambled to increase liquidity.

Amid heightened fears of a prolonged coronavirus-induced shutdown, swift fiscal and monetary stimulus settled market panic and our Australian share market quickly recovered 29% from its March lows. If you did a ‘Rip van Winkle’ to fall asleep on New Year’s Eve 2019 and wake to 30th June 2020 newspaper headlines, the negligible overall change in your investment portfolio may be a positive surprise, disguising the huge COVID-19 effect on ‘main street’ (or small business economy).

The technology and healthcare sectors led the charge, best illustrated by the performance disparity between the ‘old economy’ Dow Jones Industrial Index and ‘new economy’ NASDAQ Composite Index—up 17.8% and 30.6%, respectively during the last quarter. The top 5 companies (Facebook, Apple, Amazon, Netflix and Microsoft) now represent 25% of the market cap of the S&P500 (the largest concentration in 50 years) with the NASDAQ P/E ratio hitting 30 for the first time since 2004. When we look at this on a global scale, these 5 companies represent approximately 13-15% of the worlds large cap indices, dragging the rest of global indexes up while leading to a decline in portfolio diversification.

Yet, while some sectors held up well (technology, digital media, e-commerce), other important sectors struggled with a lingering threat of bankruptcy for stressed companies in sectors such as retail, hospitality, travel, and energy. This in turn is likely to leave unemployment rates high for some time.

Despite the market optimism, we’re increasingly concerned about the disconnect between markets and ‘main street’. The disconnect between markets and the real economy can be seen in the company earnings for the S&P 500 which are estimated to have declined by 43.9% during the June quarter – on track to record its largest decline since the December quarter 2008 (-69.1%).

The Australian economy contracted 0.3% in the March quarter of this year and given the full extent of coronavirus-related shutdowns have occurred since, it’s almost certain the Australian economy experienced its first recession in 29 years.

Markets dislike ‘unknowns’… and many remain. Will a successful vaccine be found and when? Without one, how long will it take to achieve global herd immunity? Will governments sustain financial support to those disrupted? Will they support a path back to full employment that repositions us for this Asian century? Of course, the increasing US/China trade tensions is also a threat.

Global central banks have little ammunition left, except keeping policy rates at zero (Australia currently at a record low 0.25%) and government bond yields extremely low. The RBA outlook for the economy and interest rates was recently described by Governor Lowe as a world “where there’ll be a shadow from the virus for quite a few years”, causing “deflationary forces” and “large output gaps.” In other words, slower economic growth, and low inflation, with interest stuck “at their current level for years.”

In recovering rapidly rising government debt, rates will stay low and some currencies may eventually be suppressed. Meanwhile, governments will also need to continue to support low-income families and businesses (JobKeeper, tax concessions) coupled with increased Government spending on critical long-term infrastructure projects.

Through it all, people showed amazing resilience. We saw it in our business too as we quickly adapted to the new circumstance – working from home and relying on new remote contact technologies. This once in a century pandemic continues to change the way we live.

Volatile times are never easy but investing works best with a long view where patience is eventually rewarded. It’s critical to have a robust investment strategy that’s capable of navigating through all sorts of market eventualities. The best defence to short term volatility is diversification within your portfolio and maintaining a disciplined approach to your long-term investment strategy through evolving market cycles. For individual investment holdings, it’s now particularly important to ensure you’re comfortable with each so you can stick with them through thick and thin. Our quality and value approach to stock selection is well tested over time.

Your greatest investment attribute can be patiently avoiding knee-jerk reactions while steadfastly adjusting to changing circumstances. We aim to minimise downside risk in volatile times, while still tracking the market in good times. Minimising downside loss preserves capital to benefit from positive returns in the good times.

Related insights.

How to Create a Resilient Retirement Strategy

27/6/2025

Private Wealth

One of the greatest concerns for retirees is the risk of outliving their savings. While disciplined saving...

Read more.

Show Me The Perks Podcast | Navigating the $3 Million Super Tax

5/6/2025

In this episode of Show Me The Perks, host Kim Bigg is joined by Peter Burgess, CEO...

Read more.

The Charts that Matter | Investment Update | April 2025

15/4/2025

Private Wealth

Christo Hall discusses the market impact of new U.S. tariffs, their economic implications, and what they mean...

Read more.

Want to receive our insights?

Sign up to receive important financial updates, useful tips, industry trends and whitepapers.