September Quarterly Market Recap

Posted on 12/10/2020

Investment Research

Overview:

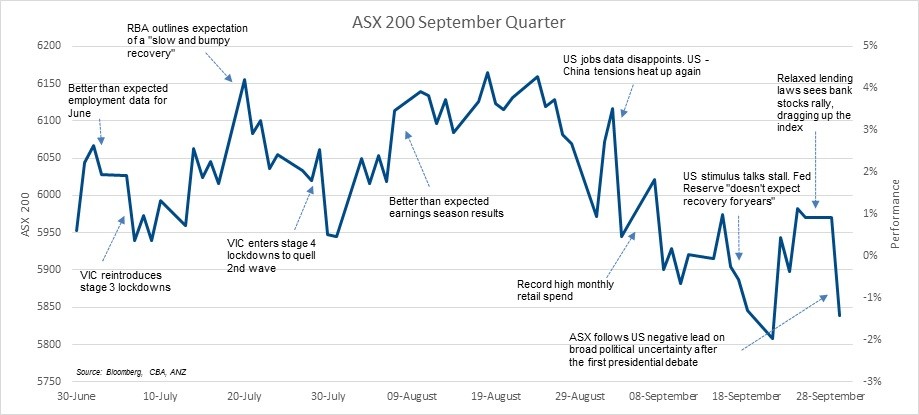

Markets had a similar soundtrack to the June quarter; keenly watched economic data and declining cases in Coronavirus kept equity markets in a tight trading range with a tug-of-war happening with positive and negative news around further stimulus, vaccine news and the run up to the November US election. Second wave outbreaks in Victoria, Europe and the United States further dampened the “V-shape” recovery story, which was confirmed by Central Banks around the world emphasising “there is a long way to go” in returning to pre-Coronavirus normalcy.

Key highlights:

- Markets started the third quarter with a risk-on tone, responding positively to the June US labour market release amongst other economic data such manufacturing, services, and strong commodities volumes. Despite the overwhelmingly grim outlook and resurgence in Covid-19 cases around the world, the Nasdaq was the first index to reclaim all loses from the first quarter market sell-off, followed by the Dow Jones and S&P 500. The ASX 200 remained in a tight 100-point range over the quarter, reverberating sideways and firmly below where it began the calendar year.

- Early data in August from the ABS showed company profits had in fact jumped 15% across the June quarter, this is largely attributable to the extent of Government subsidies. The Victorian Government also declared a state of disaster, enacting stage four lockdowns which restricted an estimated 1 million people from going to and from their workplace. Only essential businesses such as supermarkets and pharmacies remained open whilst others were forced to adopt a contactless click and collect operating system.

- The Federal Reserve left their target cash rate unchanged but moved to adopt a long-term average inflation target of 2%, with the minutes showing concern around the dire outlook for the economy. The US economy contracted at a seasonally adjusted annual rate of (-31.7%) – the steepest in 70 years – in the June quarter and jobless claims remain steady at 1m, suggesting their supercharged recovery has potentially capped.

- The RBA also left rates unchanged at 0.25%, noting “the board will maintain highly accommodative settings as long as required and continues to consider how further monetary measures could support the recover”. Given the sheer severity of the 2nd wave in Victoria, many pundits suggest the RBA may redefine the new record low for the cash rate at 0.10%.

- The reintroduction of a suite of lockdown measures in the UK (touted to last 6 months) to combat the rising cases are adding to the messy no-deal Brexit woes. The EU has started legal proceedings against the UK after Prime Minister Johnson outlined plans to breach some of the terms of the Brexit deal as negotiations faulter with the EU.

- Sector performance for the quarter: Australian Equities (-0.06%), US Equities (+8.5%), Global Equities (+6.4% Hedged, +3.78% Unhedged), Australian Fixed Income (+1.0%), Global Fixed Income hedged (+0.7%), AU Real Estate Investment Trusts (+7.4%). The Australian dollar rose from 69 U.S. cents across the quarter to finish at 0.71 U.S. cents (+3.8%).

Other points of interest:

The latest unemployment figures (August) showed a surprisingly strong leap of +111,000 jobs (+74,800 part time, +36,200 full time) or 0.9% (consensus:

-35,000, +0.2%). Total hours worked for the month however, only increased by just 0.1%. These numbers saw the unemployment rate fall to 6.8% from 7.5% (consensus 7.7%). Traditionally a lead indicator to the economic outlook, the labour market is expected to continue to send mixed signals due to Government’s employment schemes – JobSeeker, JobKeeper and now JobMaker – are seemingly distorting the data and the true pace of improvement. Despite this, total retail sales hit a record high in July, rising by 3.2% (and 12% on an annual basis). Spending rose in major categories (ex-Victoria), with some components of the reading well above their pre-Covid pace and others remaining significantly below. The most noticeable surge is in household goods (+27.9%), food retailing (12.3%), while spending at cafes & restaurants (-13%) remains down sharply. Importantly, these household goods (electrical, furniture and hardware) are typically imported goods, therefore these items do very little to boost domestic production.

The U.S. labour market key indicator, non-farm payrolls, rose by +1.371million (consensus: +1.35m) in August, bringing the unemployment rate down to 8.4% from 10.2%. Although, a series of other data readings are indicating that job losses have since risen, which is not surprising given the Paycheck Protection Program, which was supporting jobs, ceased at the end August. This has led to both the Senate and Federal Reserve call for an additional stimulus package for those affected by the pandemic, yet, unsurprisingly, neither the Democrats or Republicans can agree to the finer details of a package.

Investors continue to keep one eye on the geopolitical tension between the U.S. and China in the run up to the November Presidential Election. The Trump administration imposed export curbs on a number of products (such as semiconductors), making it a requirement now for U.S. firms to hold a license to export goods to China. President Trump again raised the idea of decoupling the U.S. and Chinese economies, vowing in future his administration would prohibit companies from outsourcing to China.

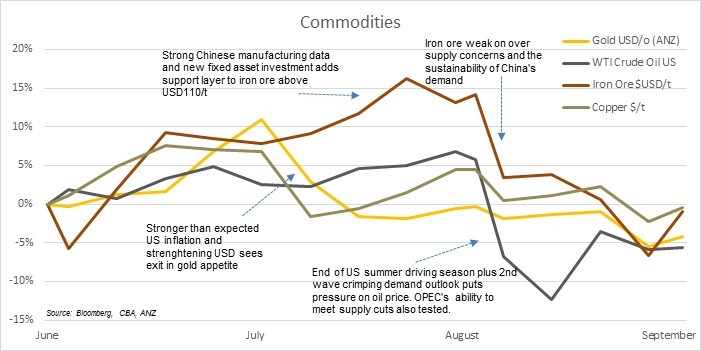

For Commodities, the price of Oil (Crude) remains trapped in a tight range as persistently weak demand permeates through the market. A lacklustre driving season in the U.S has seen the market reassess its views on the supply / demand imbalance for the remainder of the calendar year. OPEC (Organization of the Petroleum Exporting Countries) announced it was looking to tighten member nation adherence to production cuts, with the committee recommending these cuts be extended to years end (from end of August), cushioning the blow from second waves of Covid-19 travel restrictions. Iron ore remained comfortably in the USD$110-120 a tonne range across the quarter, finding a strong support base in President Xi Jingping five-year economic recovery roadmap – which includes a focus on infrastructure and housing investment. However, there was turbulence through September with a strengthening US dollar and Brazilian producer, Vale, coming back online shipping 1.9mt/d in the first 13 days of September, compared to 1.49mt/d in the 21 business days in August. This led investors to question the sustainability of China’s robust demand for the commodity. However, price strength was found at quarters end when Vale was issued with court order to shut down its operations, and a carrier at Port Headland (WA) was stranded after 17 of 21 crew tested positive to Covid-19, delaying shipments from the port.

For the Fixed Income sector, both U.S. Treasury’s and Australian Government Bonds remained anchored in a narrow range across the quarter. There is growing speculation that the two will cut rates again before the end of the calendar year. The unrelenting disconnect between the bond and equity markets remains plagued by the risk-off sentiment as investors hunt for yield. However, despite presenting as a challenge in portfolio construction, it does not change the narrative of the importance of maintaining a well-diversified portfolio.

Related insights.

Now Is the Time for True Diversification

14/7/2025

Private Wealth

Why resilience, adaptability, and strategic allocation matter more than ever. We’re living through a rare collision of...

Read more.

Show Me The Perks Podcast | Navigating the $3 Million Super Tax

5/6/2025

In this episode of Show Me The Perks, host Kim Bigg is joined by Peter Burgess, CEO...

Read more.

The Charts that Matter | Investment Update | April 2025

15/4/2025

Private Wealth

Christo Hall discusses the market impact of new U.S. tariffs, their economic implications, and what they mean...

Read more.

Want to receive our insights?

Sign up to receive important financial updates, useful tips, industry trends and whitepapers.