Save Smarter with the First Home Super Saver (FHSS) scheme

Posted on 7/11/2023

Overview:

South Australians can now save for their home deposit quicker with access to the government’s First Home Super Saver (FHSS) scheme. The FHSS scheme allows you to save money for your first home inside your superannuation fund, enabling you to build your savings quicker with the concessional tax treatment of your super.

What is the FHSS Scheme?

The FHSS scheme is a government initiative that allows you to save money for your first home within your superannuation fund. You can save money for a first home deposit with before-tax concessional and after-tax non-concessional voluntary contributions. If you meet the eligibility criteria, funds can be released to you, up to a set limit, along with associated earnings to help you purchase your first home.

You may request to allocate up to $15,000 of your voluntary contributions from a single financial year towards your eligible contributions for release under the FHSS scheme, with a cumulative limit of $50,000 across all years. You will also receive any associated earnings that are calculated based on the Shortfall Interest Charge (SIC) rate.

All released contributions under the FHSS scheme can be used to buy a new or existing home in Australia.

How can you save into your super?

Under the FHSS scheme, you can start saving by:

- Engaging in a salary sacrifice agreement with your employer for voluntary concessional contributions (please note that not all employers provide this option).

- Opting for voluntary personal super contributions that can become concessional when you claim an income tax deduction for them.

Are you eligible for the FHSS?

To be eligible for the FHSS scheme you must meet the following conditions:

- You can begin making super contributions from any age, but you must be 18 years old or older to request a determination or a release of the contribution amounts under the FHSS scheme.

- Never have owned a property in Australia, including an investment property, vacant land, commercial land, commercial property, a lease of land in Australia, or a company title interest in land in Australia (unless the Commissioner for Taxation determines that you have suffered a financial hardship).

- You have not previously requested the Commissioner to issue a FHSS release authority in relation to the scheme.

- You plan to move into the property you purchase as soon as feasible and reside in it for a minimum of 6 months within the initial 12 months of ownership.

Eligibility is evaluated individually. This means that couples, siblings, or friends can each utilise their eligible FHSS contributions to buy the same property. If any of you have previously owned a home, it will not hinder any other eligible person from applying.

Example Scenario

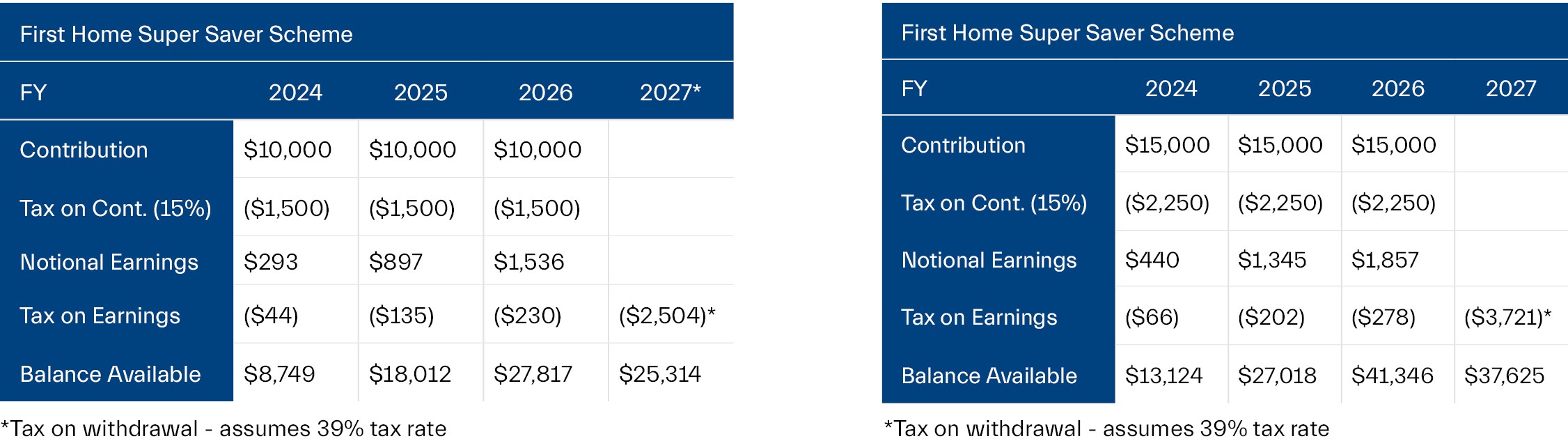

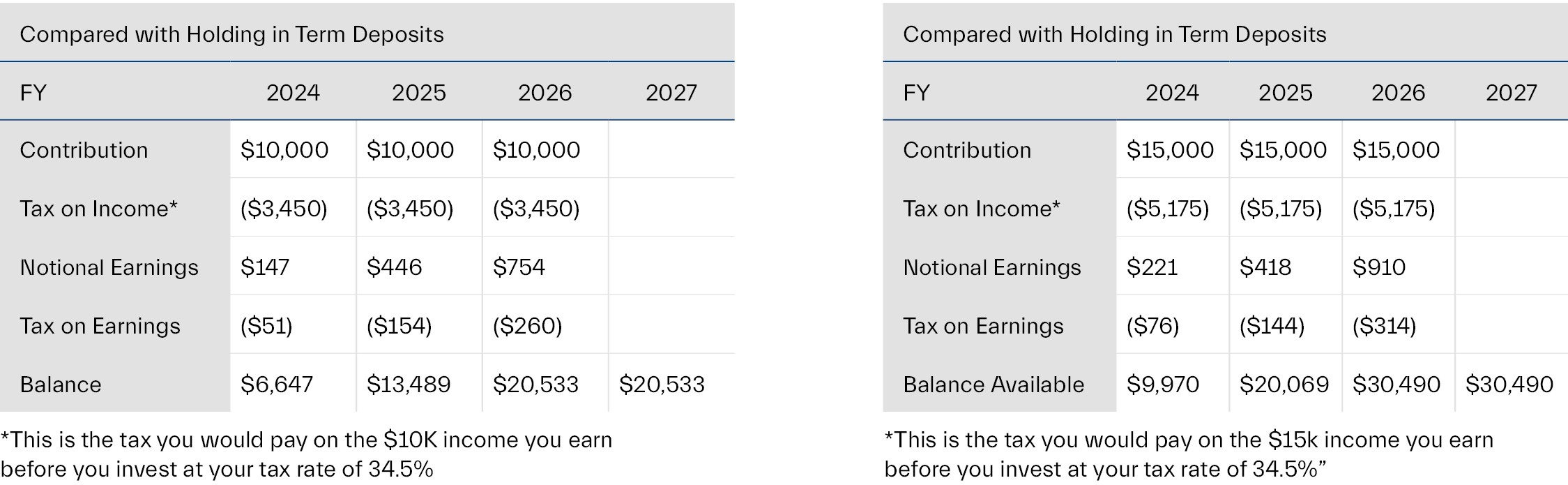

You are a first-year medical intern with the goal of purchasing your first home in Australia in the next 3 years. To fast-track your savings, you decide to go into a salary sacrifice arrangement with your employer as part of the First Home Super Saving scheme.

Assumptions

- As a medical intern, you will earn between $45k and $120k of taxable income in each year of contribution – your marginal tax rate is 34.5% including the Medicare Levy.

- You will earn between $120K and $180K of taxable income in the year you withdraw the amount from super – your marginal tax rate will be 39% including the Medicare Levy.

- Your employer superannuation contributions in any year of contribution will be less than $12,500.

- Notional earnings on savings held in super will earn the 90-day Bank Accepted Bill rate (+3%), rather than actual performance.

- Your superannuation account balance is equal to or greater than the amount available for withdrawal.

- Holding savings in an interest-term deposit account will earn 4.5% in savings, in comparison to participating in the FHSS.

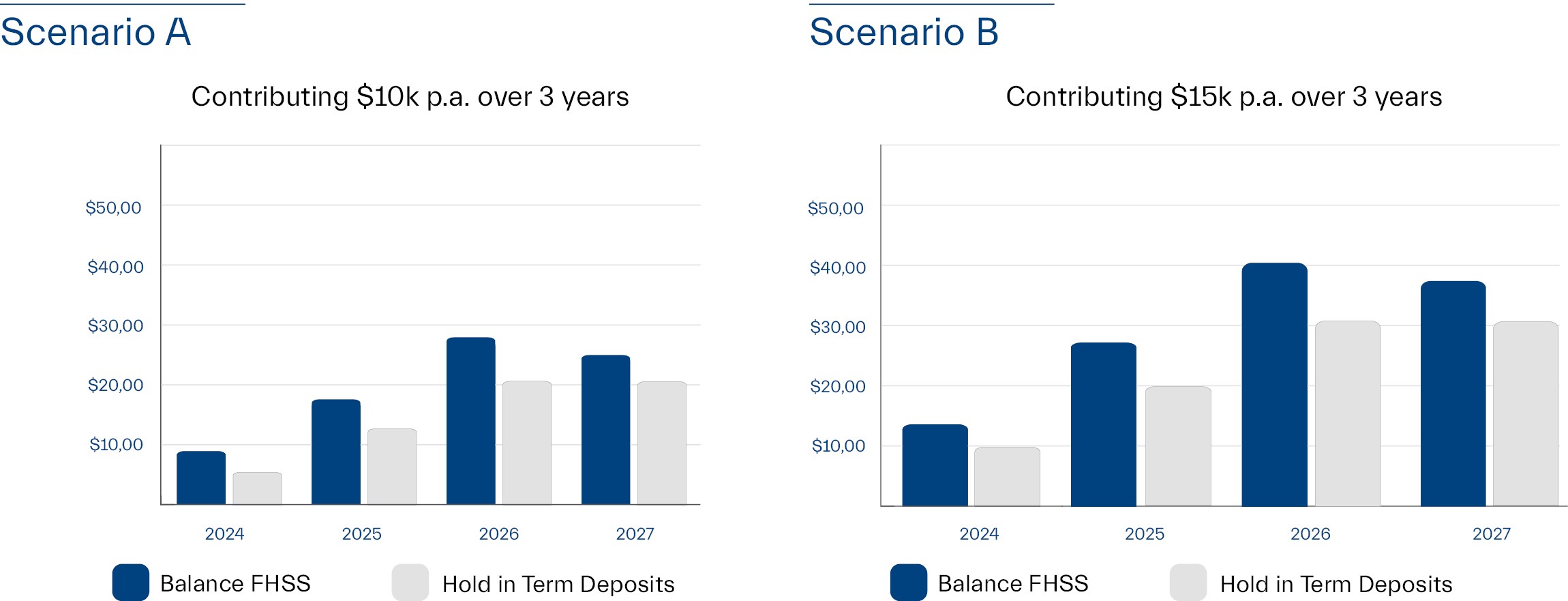

Results Scenario A

As per the above, based on the above assumptions you would be $4,781 better off using the First Home Super Save Scheme Split as follows:

Tax Savings $3,403

Additional earnings $1,378

Results Scenario B

Per the above, based on these assumptions you would be $7,135 better off using the First Home Super Saver Scheme. Split as follows.

Tax Savings $5,042

Additional earnings $2,093

To take advantage of the FHSS you can look to take the following next steps.

- Seek personalised advice from a Financial Adviser

- Contact your super fund to set up a new account if required (noting that you will be unable to use State Government Triple S Super Fund)

- Contribute your desired amount either through a salary sacrifice agreement with your employer or through voluntary personal super contributions.

At the end of the financial year, notify your superannuation fund of your intention to claim a deduction for your personal contributions.

For a downloadable fact sheet on the FHSS scheme click here.