Labor’s Tax Proposals

Posted on 15/4/2019

Overview:

Among the usual pre-election promises of widespread reform, Labor’s plans to scrap franking credit rebates for self-funded retirees has generated a whirlwind of media attention and speculation about its potential impacts on retiree income

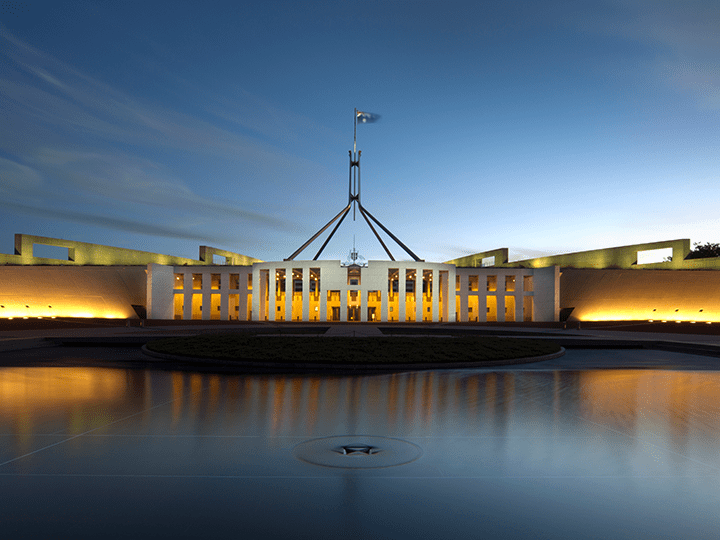

With Australia set to head back to the polls in May for another Federal Election, both sides of politics are steadily ramping up their campaigns in an effort to sway voters across the country.

Among the usual pre-election promises of widespread reform, Labor’s plans to scrap franking credit rebates for self-funded retirees has generated a whirlwind of media attention and speculation about its potential impacts on retiree income.

Though this reform has potential implications for a significant number of Australians, it is only one part of a larger tax agenda that Labor has it has promised to implement should it form government in the coming months.

No need for panic

While it is important that our clients are aware of these changes and their potential impacts (we would encourage you to read this article, which provides a good, concise summary of the proposal), there is an underlying need for a patient and considered approach to any potential asset reallocation in response, for several reasons.

Despite recent polling data pointing to a Labor win, there are no certainties in politics. In any event, with only about half of the Senate up for re-election, it is highly unlikely that a Labor government will hold the majority power in both houses of parliament. Accordingly, any changes that are brought to the Upper House will be reliant on the cooperation of cross-benchers, many of whom have already expressed concerns with aspects of the proposal.

In practical terms, the likelihood is that the legislation will be watered down, or some aspects eliminated altogether before it passes into law.

Labor has also noted that any changes will only affect new assets, meaning that currently held assets will be grandfathered, and we expect to see further changes to the proposal come to fruition post-election.

With so much water yet to go under the bridge, it makes some of the immediate responses to this proposal even more puzzling. In particular, we are already witnessing people rush to move assets out of their Self-Managed Super Funds for fear that these changes will damage the viability of the SMSF model.

For those making broad changes to their portfolio at such an early stage, this may prove to be a mistake. Naturally, it is something we are keeping a close eye on, however, at this point, there is no need for concern or any immediate action.

Importantly, you can be assured that your Perks adviser will continue to monitor the situation closely so that you are informed of any changes in legislation that may occur and will have a material impact on your individual financial circumstances.

If you have any questions or concerns, please don’t hesitate to get in touch with your adviser.

Related insights.

Show Me The Perks Podcast | Navigating the $3 Million Super Tax

5/6/2025

In this episode of Show Me The Perks, host Kim Bigg is joined by Peter Burgess, CEO...

Read more.

Show Me the Perks Podcast | The $3 Million Super Tax: Will it affect me?

10/11/2023

In the latest episode of Show Me The Perks, Kim Bigg, sits down with the Simon Wotherspoon,...

Read more.

2023-24 Federal Budget Summary

11/5/2023

Tax

The 2023-24 Federal Budget was delivered by Treasurer Jim Chalmers this week. As more detail is released...

Read more.

Want to receive our insights?

Sign up to receive important financial updates, useful tips, industry trends and whitepapers.