June Quarterly Market Recap

Posted on 16/7/2020

Overview:

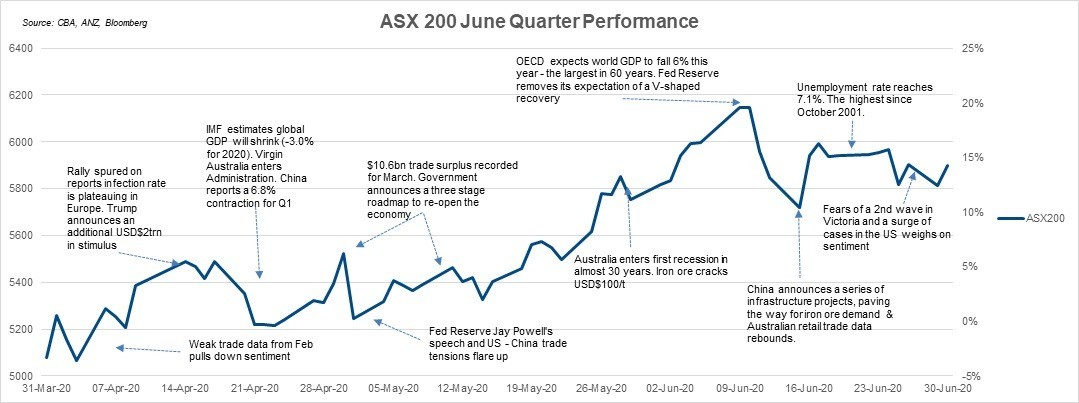

Improving trade and retail data coupled with a rollback in social distancing requirements spurred on a record rally across the quarter, however, this was met with warnings of gloomy economic outlooks from the International Monetary Fund and Central Banks alike. Australia entered a recession for the first time in nearly 30 years and employment leapt to 7.1%. Fears over surging cases in the United States and a second wave locally in Melbourne, Victoria, pulled back market momentum towards the end of the quarter.

Key highlights:

- A rally at the beginning of the quarter through to mid-June overlooked a swathe of sour economic data as Europe and New York seemed to be passing through their peaks of infections. By month end, fears of a 2nd wave were in full swing as some US states looked to re-instate lockdown measures. ASX listed companies raised a record $11bn from equity placements to weather the coronavirus pandemic. Data from Bloomberg shows this is more than any previous month on record – during the depths of the financial crisis, ASX listed companies raised $7.4bn in a single month.

- The IMF has forecast the global economy to contract 3% in 2020, much worse than the 0.1% decline in 2009 and a 6.3% downgrade since their January forecast. Its base assumption, that the pandemic fades in the second half of 2020 and containment can be gradually unwound and expects to see global growth rebound 5.8% in 2021. The OECD (Organisation for Economic Co-Operation and Development) forecasts assume that the virus eventually recedes, but they said a second wave is equally as likely. The OECD expects world GDP to fall 6% this year- the largest ever in the 60 years of the OECD, while loss of income exceeds any previous world recession over the last 100 years (ex-war time).

- President Trump revived the threat of imposing new tariffs against China in what he labelled as a retaliatory response for China’s poor handling of the Covid-19 outbreak. Australia was also caught up in the trade tensions; China blacklisted four abattoirs and imposed an 80% tariff on all Australian barley. Market participants suggested this is politically motivated following Prime Minister Scott Morrison’s push for an independent enquiry into how China informed the world about the Covid-19 outbreak.

- Treasurer Josh Frydenberg declared Australia in a recession after an almost 30 year long-run of economic growth. Real GDP fell by 0.3% in Q1 2020, annual growth dipped to 1.4%. The data captures some of the initial impacts of the Covid-19 pandemic, noting that the most stringent lockdown measures were introduced on March 23.

- Cash rates remained unchanged in Australia (0.25%) and the United States (0.0% – 0.25%). RBA Governor Phillip Lowe continuing to opt for quantitative easing measures and ensuring market liquidity, instead of negative interest rates.

- Australian Government’s economic support package to combat the Covid-19 pandemic has once again expanded, with the ‘Home Builder’ scheme being announced.

- Key purchasing manufacturing indexes (PMIs) around the world edged towards normal levels as restrictions eased and there was a pick up in consumer and business demand.

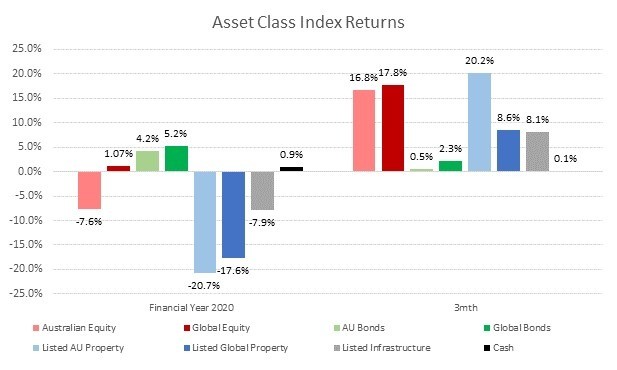

- Sector performance for the quarter: Australian Equities (+16.8%), US Equities (+19.95%), Global Equities (+17.8% Hedged, +5.94% Unhedged), Australian Fixed Income (+0.5%), Global Fixed Income hedged (+2.3%), AU Real Estate Investment Trusts (+20.2%). The Australian dollar rose from 61 U.S. cents across the quarter to finish at 0.69 U.S. cents (+13.7%).

Other points of interest:

Reflective of Australia entering its first recession in nearly 30 years, labour force data showed the number of jobs fell by 228,000 (89,000 full time and 139,000 part time) in May. This follows the eye watering drop of 607,000 in April. This takes the unemployment rate to 7.1%, the highest since October 2001 and is the second biggest monthly fall in unemployment since records began in 1978. Although, this level of 7.1% is misleading, recalling that those on JobSeeker and JobKeeper programs are still counted as employed. If everyone who lost their job were counted, the real unemployment would be near 11.3%.

The U.S. economy unexpectedly added jobs in May, with more than 2.5m people newly employed according to the Labour Department – but this still follows a record drop of more than 20m in April. The added jobs bring the unemployment rate down to 13.3% from 15%. Similarly to Australia’s figures, it is important to acknowledge that the added jobs are reflective of those sectors hardest hit (hospitality and travel) benefiting from the Paycheck Protection Program, which provides funding to small businesses that keep workers on payroll, meaning people may still be technically employed, despite not working.

U.S. and China trade tensions continued to bubble away across the quarter with President Trump mentioning a “complete decoupling” from China remains an option, mulling over the idea of terminating the Phase-1 agreement. The geopolitical chess game continued with China ordering state-owned firms to halt purchases of U.S. soybeans and pork in retaliation for Trump’s announcement he would end special treatment for Hong Kong following China’s controversial security bill. Going a step further, Trump also suspended passenger flights from China-based airlines.

For Commodities, the price of Oil (Crude) surged (+91.56%) across the quarter; rallying from $20.5/b to $39.27 fuelled by OPEC (The Organization of the Petroleum Exporting Countries) extending its production cuts until August. However, the rally was caped as virus related demand concerns resurfaced with a halting in the reopening of some U.S. states as the number of infected continues to surge beyond control, particularly in Texas. Iron ore broke through USD$100 a tonne for the first time in 10 months amid supply concerns in Covid-19 ravaged Brazil continue to disrupt mining operations in the country (Brazil accounts for ~21% of global seaborne trade). Data from Bloomberg shows Australian exports surged to fill the demand gap, exporting 79.7mt in May, the highest on record. Further encouraging the price was improving demand from China, imports rose 3.9% year on year in May, bringing total demand for calendar year 2020 up 5% (remembering that a series of new infrastructure projects have been announced in conjunction with steel mills reopening).

For the Fixed Income sector, Domestic Fixed Income (+3.0%) for the quarter, outperforming their Global Fixed Income equivalents by (+1.5%), who returned a weaker (+1.5%) over the period.

Related insights.

Perks Welcomes New Directors to its Group Board

8/1/2024

Original Article: September 2023

We welcome two new members to the Perks Group Board and look forward to them making a...

Read more.

Show Me the Perks Podcast | From Nest to Nest Egg: A guide to the First Home Super Saver Scheme

28/11/2023

In this third instalment of Show Me The Perks, our host Kim Bigg chats to Sam Wagner,...

Read more.

Show Me the Perks Podcast | The $3 Million Super Tax: Will it affect me?

10/11/2023

In the latest episode of Show Me The Perks, Kim Bigg, sits down with the Simon Wotherspoon,...

Read more.

Want to receive our insights?

Sign up to receive important financial updates, useful tips, industry trends and whitepapers.