Equities

There is no question about the strength of the recent market rally, in fact, it was the strongest financial year return since 2006/07. As the final quarter drew to a close, performance was mixed as the tug-of-war between growth and value continued, leaving the index treading water after a steady ease in bond yields and renewed virus fears amid the Delta strain outbreaks saw the great rotation from growth to value seemingly stall. Locally, over the quarter Tech returned (+12.12%), Consumer Discretionary (+11.20%), Health Care (+9.04%). The laggards were Energy (-2.83%) and Utilities (-4.52%). Globally, the Federal Reserve’s latest meeting saw a tonal shift slightly more ‘hawkish’, leaving investors to digest the reality that interest rate rises may be sooner rather than later as Central Banks look to taper stimulus programs and aim to keep inflation under reigns, avoiding potential irreparable surges. In the U.S. CPI jumped by the largest amount in since 2008. The stronger producer prices (raw materials, commodities) suggest there will be upstream pressure for consumers in the near term as businesses grow more reluctant to absorb rising costs and begin to pass them on. Despite not matching the broader market returns, listed property had a stellar year nonetheless, returning 8.8% (9.5% including dividends) as measured by the S&P/ASX200 A-REITs index. Industrials were the outperformer, owing to high consumer demand and limited supply chain capacity. Logistics assets were also major beneficiaries from the behavioural shift, and broad adoption of e-commerce in the retail sector. This rapid change has seen underinvestment from years past flipped on its head, suggesting the near-to-mid-term environment will remain supportive for the sector. Any relative performance in the Office segment remains contingent on vaccine rollout timeliness, containment success, and how landlords navigate the reality that the five-day working week in the office may be no more as businesses move to flexi arrangements, requiring less floor space.

Commodities

Gold’s nature as a non-yielding asset has seen it spend less time in the sun recently compared to other ‘risk-off’ constituents, with investors opting for USD and bonds during moments of volatility. The latest inflation data saw the precious metal gain popularity amongst investors looking to hedge against effects. Softening bond yields across the quarter also contributed to performance, but the general risk-on mood and economic outlook remains a headache to upside for the commodity. Oil extended its recent run after over 60% of the U.S. population has received at least one vaccine dose, adding to demand. Global stockpiles are also normalising on the back of the OPEC+ groups supply side discipline. Iron ore and Copper have been supported by swathe of ‘build back better’ infrastructure projects pledged by Governments. Fundamentals remain supportive for both of the key input commodities, although the threat of increased regulation from Chinese authorities in iron ore markets pose a short-term risk to price.

Australian Economy

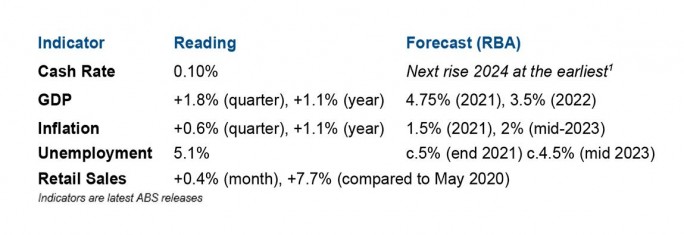

GDP continues to highlight the strength of the Australian economy, coming in above consensus of +1.5% to be now 0.8% above December 2019 (pre-pandemic). The latest data confirms Australia is now transitioning from recovery into expansion. Commodity prices are significantly contributing to the growth profile, while company and household savings are normalising as government support is wound back (JobKeeper).

Employment rose by 115,200 in May (full time 97,500, part time 17,700), substantially stronger than consensus for a 30,000 lift. This is now the second month post-JobKeeper, and the Australian Bureau of Statistics notes it did not “identity a clear aggregate impact from the end of JobKeeper”. However, post this data release, much of the country has re-entered lockdown without the wage subsidy, which may have a larger impact than previously observed.

Currency

The RBA (Reserve Bank of Australia) at its latest meeting (July) has maintained the cash rate at 0.1% with Governor Lower reiterating that any changes1 to this are dependent on the data, not the date; and is based on inflation outcomes, not the calendar (inflation to be sustainably within 2-3% band and wages growth by the same measure).

The RBA’s gradual taper of its current asset purchase program ($4bn in purchases until at least November, the current pace is $5bn) are expected to result to slight weakness in the AUD against a strengthening USD (on an interest rate differential basis). But, given the AUD reputation as a ‘growth’ proxy, persistent strength in commodity prices can combat against any weakness, supporting the currency at present levels for the remainder of 2021 and into 2022.

Fixed Income

The Australian Federal Budget was well received by debt markets, with the deficit smaller than previously pencilled in (owing to the strength of the labour market and commodity prices). Although for much of the year to 30 June, yields on longer dated bonds grinded higher as investors cheered on the economic recovery – markets are now of the belief the risks of inflation are greater than the opposing risk of the economy being weak. A tightening cycle in monetary policy from central banks (rising interest rates) would slow economic activity and lead to a rise in shorter-dated bonds, i.e., a flattening yield curve.

^Indexes used S&P/ASX200 TR (AUD), Dow Jones Industrial PR (USD), S&P500 PR (USD), FTSE100 PR (GBP). Data Sourced: RBA, ABS, Morningstar, CBA, ANZ.