A guide to income protection & TPD insurance.

Posted on 8/1/2024

Income Protection & TPD Insurance.

Overview:

Protect your biggest asset, the ability to generate an income. Income protection and TPD insurance can ensure both you and those closest to you can sustain the lifestyle you have worked hard to achieve, even if you are unable to work through illness or injury.

Envision this, you are a qualified General Practitioner after several years of university study and industry placements. You are working at a local GP clinic where you enjoy regular interaction with patients and consider yourself to be at the top of your profession. Each month you earn $15,000, which contributes to your mortgage, day-to-day expenses, and supporting your family. One day, after a routine checkup, you are diagnosed with prostate cancer and are immediately required to take time away from work to undertake chemotherapy as well as ongoing medical treatment with no return date in sight. Without the ability to earn an income, would you be able to support your ongoing costs, your family, and maintain the lifestyle you once had?

This is where the safeguard of income protection comes in. In monetary terms, your ability to generate an income is your biggest asset by far, so protecting this, like your home and vehicle is imperative. When protecting your biggest asset, there are three key points to understand to ensure you know what you’re covered for, and what it means at claim time:

- How much are you covered for i.e. the amount insured.

- How long you will need to wait before your claim can be paid i.e. the waiting period.

- How long your claim will be paid out i.e. the benefit period.

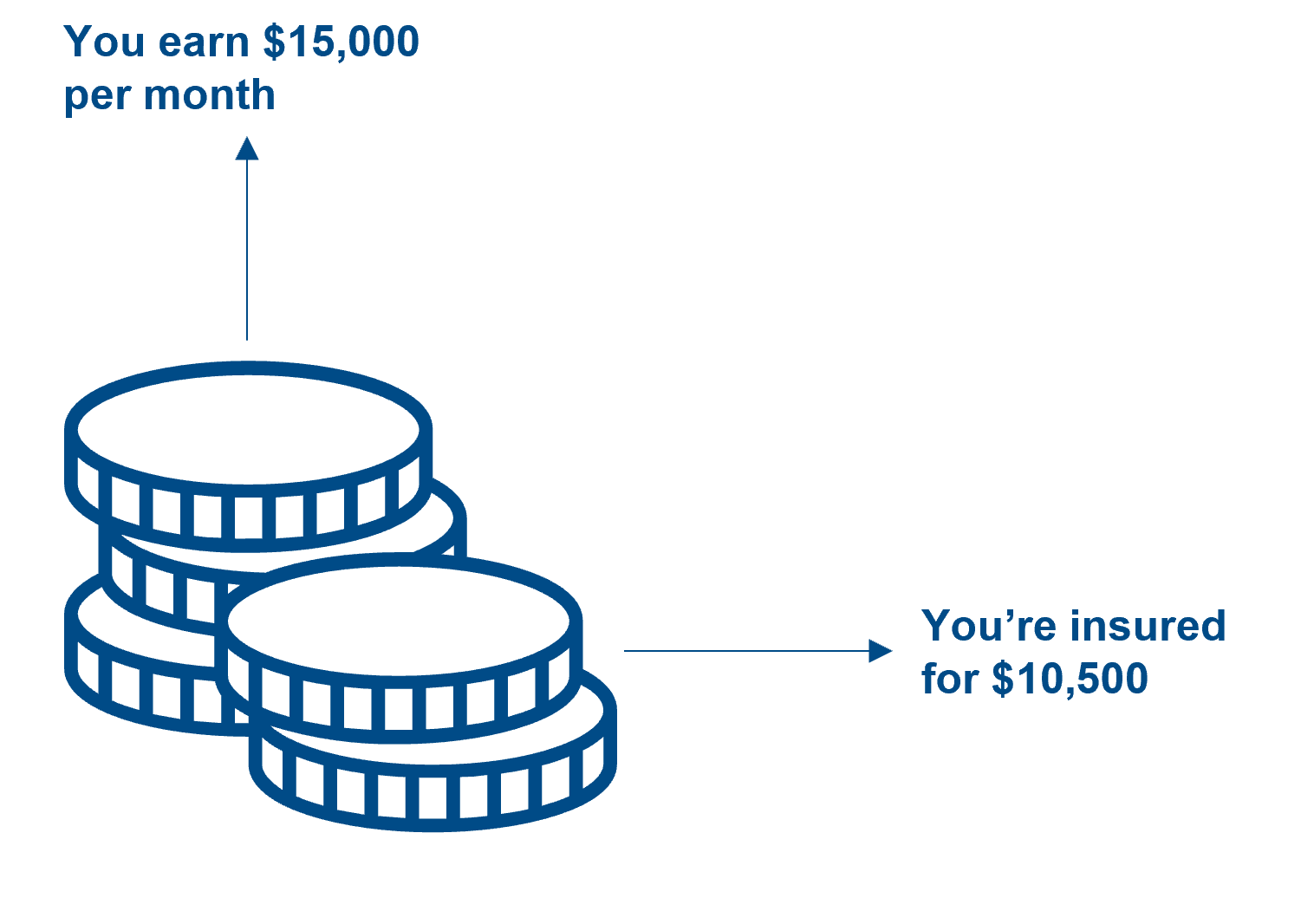

What amount are you covered for?

In most cases, income protection ensures up to 70% of your monthly income should you get sick or injured and as a result, you are unable to work.

It is important to consider, however, that the higher the sum you are insured for, the higher your premiums, so you will need to understand how much cover is required to meet your everyday expenses and a considered lifestyle change. These expenses may include rent and mortgage repayments, bills, groceries, and school fees. Ongoing costs such as car registration and other insurance costs should also be considered.

How long will you be waiting to receive your first payment?

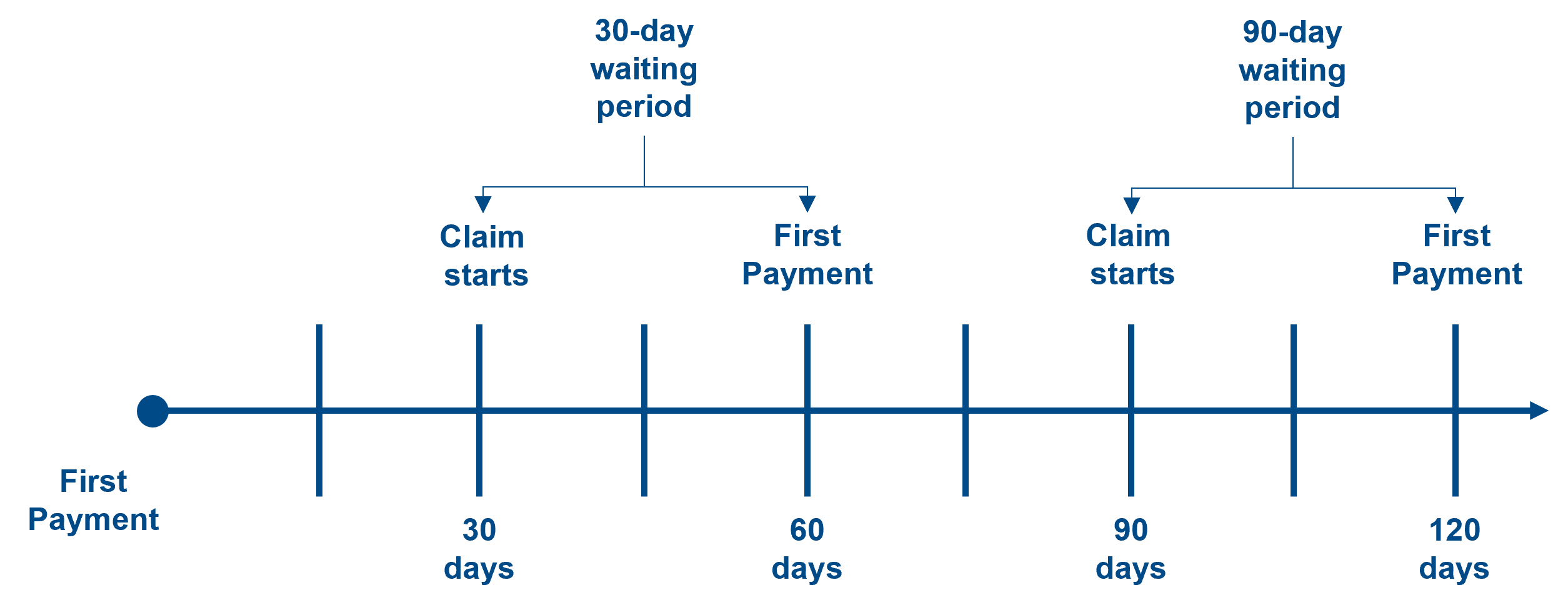

A waiting period is the number of days before you will be eligible to claim after you have been confirmed as unable to work. The most common waiting periods are 30 days, 60 days, and 90 days.

Payments for income protection are usually made monthly after a claim. So, if you chose a 30-day waiting period, your first payment would come 60 days after you become unable to work.

The waiting period also affects the cost of your premiums. Typically, a policy with a 30-day waiting period is more expensive than a 90-day waiting period, because of the ability to claim sooner.

The key consideration when choosing your waiting period is how quickly you will require financial support if your income stops:

- With a high level of sick leave, annual leave, or savings, you may consider taking a longer waiting period to reduce your premiums.

- As a casual employee or business owner, you may consider a shorter waiting period, however, you can expect higher premiums.

How long are you covered for?

When deciding on a policy, you will need to select a benefit period. The benefit period is the maximum amount of time you will be eligible to claim income protection payments whilst you are unable to work. Income protection policies typically provide options of two or five-year coverage, or until a designated age, such as 65, and your choice can make a difference to the total amount you receive.

For example, you become permanently disabled at the age of 40 and are unable to return to work. With a 2-year benefit, your payments would stop at the age of 42. With a benefit period to the age of 65, you would be eligible to receive these benefit payments for an additional 23 years.

Opting for a longer benefit period increases the policy’s cost because the potential payout is higher. It is important to consider that the benefit period is the maximum amount of time you can receive payments. If you can return to work earlier than your maximum benefit period, or you reach the maximum benefit period, benefit payments will be stopped.

A ‘partial disability benefit’ is helpful to those who are able to return to work on a part-time basis whilst continuing to recover from illness or injury. A partial benefit will pay reduced payments until you are back to earning your pre-claim earnings. This opens the ability to continue to generate an income with restricted abilities or try a new occupation.

Can you claim income protection on tax?

Income protection premiums are generally tax-deductible, making the action to safeguard your income even more cost-effective.

What is Total and Permanent Disability insurance?

Total and Permanent Disability (TPD) insurance pays out a lump sum payment if you suffer an injury or illness that leaves you permanently unable to work. This lump sum allows you to cover such expenses as medical costs while continuing to support your day-to-day expenses.

Own vs Any occupation

When taking out a TPD policy, you will typically get to choose between two options of cover:

Own occupation cover results in your claim being assessed against your ability to perform the specific requirements of the job at the time in which you stopped working due to illness or injury. This policy is suited to people who have trained or studied to enter specialised fields or are within a specialised trade.

Any occupation cover results in your claim being assessed against your ability to perform any job based on your level of education or that you are suitably qualified for.

In summary, taking out an income protection or TPD insurance can protect against the financial hardship of losing your ability to make an income due to an unforeseen illness or accident, and can support you to turn a financial burden into a manageable scenario.

To safeguard yourself against life’s risks, get in touch with a member of our Perks Insurance Team who will discuss your circumstances and provide a Statement of Advice to suit your needs.