Government Cuts HELP Debt by 20%: What You Need to Know

Posted on 8/9/2025

Overview:

The Australian Government has announced a one‑off 20% reduction to outstanding HELP and other student loan balances as of 1 June 2025. The ATO will apply the change automatically, with no action required from borrowers.

This 20% reduction by the Government will benefit more than 3 million Australians with student loans, wiping out over $16 billion in HELP and related debt.

It comes on top of the $3 billion already removed through the Government’s earlier reform, which capped student loan indexation at the lower of the Wage Price Index (WPI) or Consumer Price Index (CPI). In practical terms, this means indexation will never outpace wage growth, making repayments fairer and more predictable.

Key Changes

• Who’s eligible?

Anyone with a HELP or related student loan on 1 June 2025 (HECS‑HELP, FEE‑HELP, SA‑HELP, OS‑HELP, STARTUP‑HELP, VET Student Loans, Australian Apprenticeship Support Loans, Student Start‑up Loans and the Student Financial Supplement Scheme).

• How it works

The 20% cut is calculated first on your pre‑index balance, then the usual 2025 indexation (3.2%) is applied to the reduced amount.

• Do I need to apply? No. The ATO will automatically update accounts; you can monitor your balance via myGov – ATO Online Services.

What this means for you

• Cash flow relief and faster payoff: Lower balances mean smaller compulsory repayments and a shorter repayment horizon for many borrowers, especially when paired with the new, fairer marginal repayment settings in the same reform package.

• Borrowing & Home buying readiness: Lenders typically factor HELP repayments into servicing calculations. A lower balance can improve overall borrowing capacity and help first‑home buyers progress sooner.

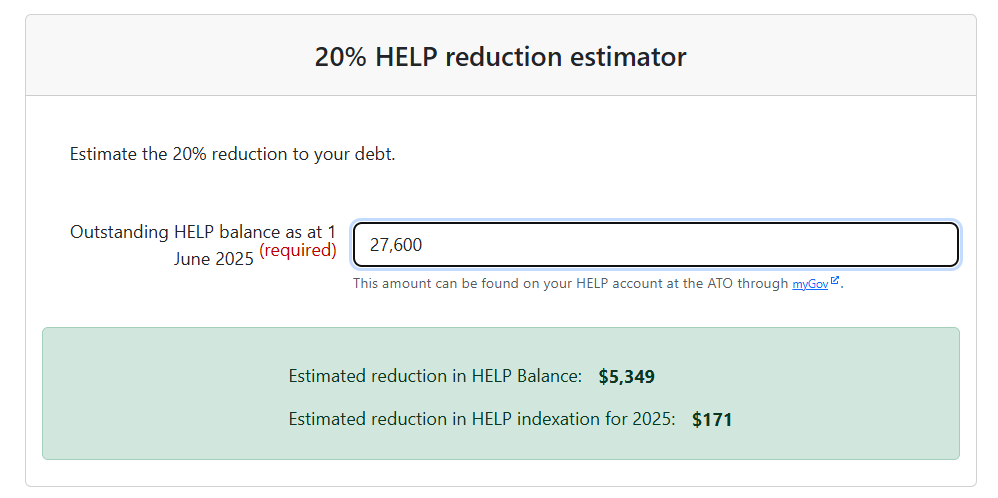

How the 20% reduction is applied (Simplified example)

Source: https://www.education.gov.au/help-debt-reduction-and-repayment-estimators

What to do next

• Wait for the ATO update and check your balance in myGov > ATO Online Services once the Government confirms processing is complete. The credit to the balance in myGov is expected to be applied before the end of December 2025.

• Hold off on extra payments until your reduction shows, unless you have a specific reason to pay sooner. The cut is based on your 1 June balance.