December Quarter Investment Market Recap

Posted on 22/1/2020

Overview:

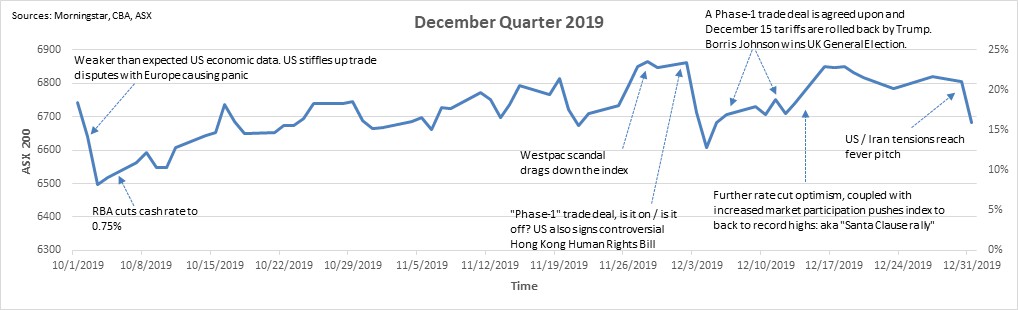

Global market talk was dominated by the U.S. – China agreeing to an interim trade deal and the UK general election, translating to a positive finish both to the quarter and calendar year. Locally, Westpac found itself firmly in the cross-hairs of regulators during November for a string of serious breaches. The RBA rate decisions and commodity prices remain as key areas of focus for Australian Investors.

Key highlights:

- The quarter began with the fifth significant drawdown since the beginning of the US / China trade war in early 2018. The Aussie dollar hit a decade low of 67 US cents.

- The RBA cut the cash rate for the third time in 2019 citing the rationale behind the cut as a move to combat rising unemployment in the Australian economy.

- In November, ASIC announced it would investigate Westpac’s $2.5bn capital raising over whether they adequately informed investors of alleged money laundering violations before selling $2bn of new shares to institutional investors. $500m of the capital raise, aimed at retail investors, were offered the ability to withdraw from the placement.

- RBA Governor Phillip Lowe outlined the banks thinking on low interest rate monetary policy in Australia. He stressed that the bank had no current appetite for unconventional economic stimulus methods (bond purchasing) in Australia, believing 0.25% is the effective lower-bound in Australia and that negative interest rates are extraordinarily unlikely.

- As December rolled around, Boris Johnson was re-elected as Prime Minister in the UK General Election. Brexit is almost certain one way or another now, with the leave date now pencilled in as 31 December 2020 or unless a deal is reached prior.

- The US and China agreed to a Phase One trade deal, which saw markets rally in the second half of December.

- President Donald Trump is just the fourth in US history to confront an impeachment hearing, with Speaker Nancy Pelosi directing the democrats to write two articles of impeachment for abuse of power and obstruction of Congress

- Markets finished the calendar year slightly wobbly amid tensions between the US and Iran flaring up as the two nations trade tit-for-tat attacks.

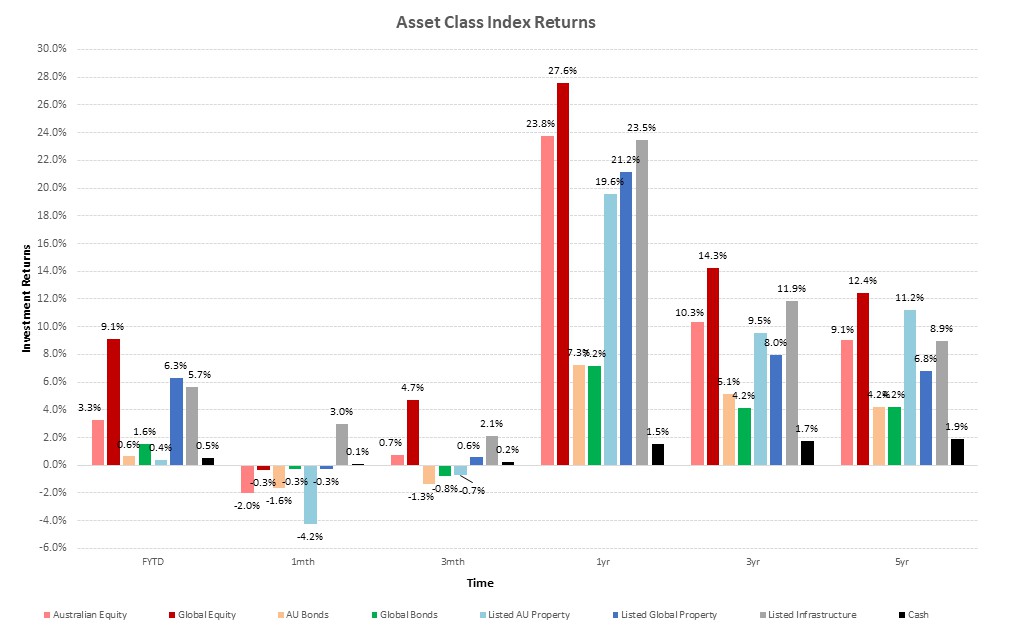

- Sector performance for the quarter: Australian Equities (+0.68%), US Equities (+4.6%), Australian Fixed Income (-1.3%), Global Fixed Income (-3.6%), Real Estate (-0.1%).

Other points of interest:

The interim deal between the U.S. and China will see the relaxation of current tariffs imposed, and a rollback of future planned tariffs. Seemingly, this appeared to be a positive way to wrap up the 2019 calendar year, however markets backflipped late December and sold off shares to reflect tensions between the US and Iran going tit-for-tat with missile strikes on infrastructure from each side within Iran & Iraq.

Prime Minister Boris Johnson lead his Conservative party to a landslide victory at the December General Election, ending the political uncertainty that was weighing down UK markets. With Johnson now holding a majority and no more extensions available, Brexit is now certain to occur on January 31, 2020.

Locally, Australian shares followed the positive global theme for 2019 with the S&P/ASX 300 index returning 23.8% for the year. Health Care remained the strongest performing sector, while IT also appeared to thrive in the risk-on market environment. The tax rebates promised in the last Federal Election continued to trickle into the Consumer Discretionary segment of the economy, helping the retail sector navigate a continuously difficult landscape.

For Commodities, Australian iron ore has and is still expected to face an interesting few months ahead. The impacts of the 18-month long trade war between the US and China can be illustrated in the weakening Chinese manufacturing demand. Although the Chinese Government has committed new fiscal measures to assist financing infrastructure projects to facilitate some growth stimulus, weaker demand is expected to ensue in line with seasonal production cuts as winter approaches. This may carry into 2020 as a potential oversupply in the market.

The housing market remains as a bright spot for the Australian economy as prices again rose in November but finished off the quarter flat. This is line with broader building activity is showing signs of stagnation, suggesting that a lack of new residential construction is still a drag on growth.

For the Fixed Income sector, although experiencing lower yields, still present as a balanced option for investors portfolios if growth trends downward again.

Related insights.

Perks Capital Conversations Podcast | Investing Beyond the Noise

12/2/2026

This episode explores long‑term investing in increasingly short-term markets. We open with Christo Hall on market sentiment,...

Read more.

Inheriting Wealth: What Women Really Want from Advice

18/12/2025

As more Australian women inherit significant wealth, the traditional financial advice model is falling short. Women today...

Read more.

Show Me The Perks Podcast | Personal Insurance: Protecting Your Most Valuable Asset

11/12/2025

In the latest episode of Show Me The Perks Podcast, host Kim Bigg welcomes Eddie Bell, Director...

Read more.

Want to receive our insights?

Sign up to receive important financial updates, useful tips, industry trends and whitepapers.