March 2021 Quarterly Market Recap

Posted on 5/5/2021

Overview:

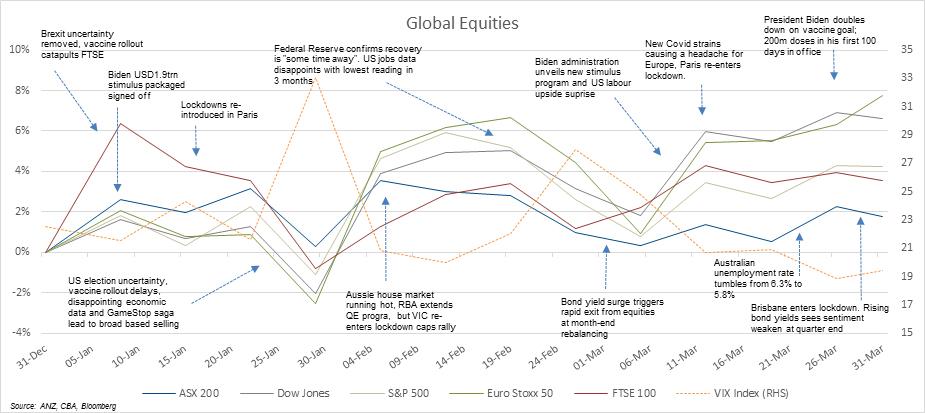

The major developed market indices had a robust yet turbulent quarter as investors contested with rising inflation expectations, shaky vaccine rollout momentum and side-effects, new COVID-19 strains, lockdowns and improving economic data.

Key Highlights

- The tumultuous chapter that was the Trump administration came to an end with Joe Biden officially inaugurated as President. Following the USD $2trn pandemic relief package, preliminary details of the Biden administrations USD $3trn multi-part “Build Back Better” infrastructure plan were unveiled, aimed at addressing climate change and improving US manufacturing competitiveness in emerging technologies (renewable energy and electric vehicles). Repayment of this ever-growing budget deficit remains a key risk for both equity and bond markets, with corporate tax hikes touted as one solution (raising the tax rate to 28% from 21%).

- At the latest US Federal Reserve meeting the target funds rate was unchanged at 0.0% – 0.25% with the minutes noting the US economy “is a long way from our employment and inflation goals, and it is likely to take some time for substantial further progress to be achieved”. Chairman Powell reiterated tapering of the current bond buying program would not occur anytime soon. The Fed also increased its GDP forecast to 6.5% in 2021, from the previous 4.2%.

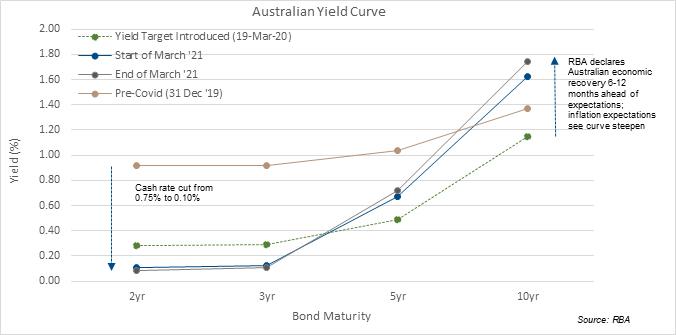

- After its annual January hiatus, the RBA again left the cash rate anchored at 0.10%, although it did announce an extension beyond April to its current quantitative easing (QE) program of $100bn over six months. Governor Lowe reiterated the banks of subdued conditions that would mean the cash rate target is unlikely to be met until “2024 at the earliest” but balanced this by saying “the economic recovery is well under way and has been stronger than was earlier expected”.

- Australia’s medical regulator, the Therapeutic Goods Administration (TGA) gave the greenlight for use of a second COVID-19 vaccine, paving the way for both leading vaccines (AstraZeneca and Pfizer) to be distributed across the country. The Federal Government’s vaccine program began in March.

- The surge in bond yields (10yr) since the start of the year caused by a stronger economic recovery than anticipated has been significant and is causing some concern among investors. Although yields are currently around the same level as they were pre-COVID, it was the rate of the rise that spooked the market. Yields have since flatlined as inflation has been held down by weak wage growth but continues to be a factor worth watching. The recovery has also seen a rotation in equity markets to more cyclical sectors (value) and away from growth.

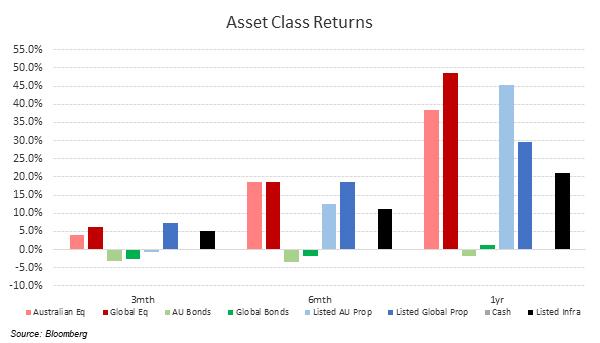

- Sector performance for the quarter: Australian Equities (+4.26%), Global Equities (+6.15%), Australian Fixed Income (-3.22%), Global Fixed Income (AUD Hedged) (-2.53%), AU Real Estate Investment Trusts (-0.56%). The Australian dollar slipped a skinny $0.01 across the quarter to buy $0.7602 US cents after reaching a high of $0.80 US cents.

Australian Equities: S&P/ASX 200 TR, Global Equities: MSCI World ex Australia NR Index (AUD Hedged), Australian Fixed Income: Bloomberg AusBond Composite 0+ Year Index AUD Global Fixed Income: Bloomberg Barclays Global Aggregate TR Index (AUD Hedged), Australian Real Estate Investment Trusts: S&P/ASX 300 A-REIT TR Index AUD.

Other Points of Interest

There were clear winners and losers on the ASX over the quarter. Driven by a ‘reflation trade’, value stocks outperformed their growth counterparts; Financials (+12.14%) and Energy (+3.26%) against Information Technology (-10.3%) and Healthcare (-2.15%). Behind these numbers is the improving economic outlook and corresponding rising bond yields that are fueling the rotation into cyclical and value-centric sectors as investors adjust their future interest rate expectations. This is a headwind for growth-orientated sectors, as a higher discount rate is applied to future earnings to reflect the increase in a company’s cost of debt.

The February labour force figures from the ABS showed 88,700 jobs were added (Full time +89,100. Part-time -500). The participation rate was also unchanged but has noticeably increased by 0.2pts over the year to February. The next test for the labour market will be the expiration of JobKeeper at 31 March, at the end of the program there were an estimated 900,000 recipients (at its peak around 3.6million Australians were receiving JobKeeper payments).

In the U.S., the Biden administration’s USD1.9 trillion pandemic relief package was signed off, paving the way for an estimated 85% of Americans to qualify for the USD1,400 stimulus cheques, this takes the total value of stimulus since COVID-19 began to USD5.2 trillion. The US unemployment rate is at 6.2% and the participation rate steady at 61.4%. Most job gains were observed in leisure and hospitality sectors (i.e. restaurants and bars) as restrictions eased and the infection rate recedes. Economists noted that the uptick in jobs suggests the labour market is responding to the December stimulus package. This implies further gains down the line after this latest stimulus packages makes its way throughout the economy. The Biden administration’s vaccine program also set a strong pace achieving its goal of 100 million doses in the first 100 days in office roughly 6 weeks earlier than expected.

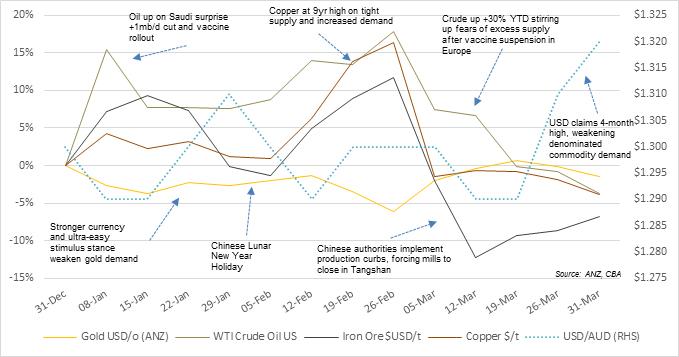

In the commodities space it was a choppy month for oil, copper and iron ore, while gold struggled against a stronger currency and rising bond yields (as it is a non-yielding asset). As a function of both the vaccine rollout (rising demand) and a surprise production cut (lower supply) of 1 million barrels per day from Saudi Arabia the price of crude oil shot up, but a stronger USD eased price momentum. Copper claimed a 9-year high on increasing demand expectations; President Biden outlined intentions for a USD$2 – 4 trillion infrastructure plan with a centerpiece around renewable energy, batteries, electric vehicles and charging stations networks. Iron ore also etched out a 9-year high on demand outlook but quickly retraced these gains after the National People’s Congress in China announced it would be targeting 6% GDP growth in 2021, much lower than market expectations.

The Fixed Income sector came into the spotlight as yields rose sharply. Across the quarter the Australian Government 10yr yield jumped from 0.97% to 1.74%, its US counterpart followed a similar trajectory 0.92% out to 1.74%. However, yields across the 0–3-year bonds remained largely unchanged due to central banks bond buying (QE) programs. Over the coming quarter, investors should expect to see the post vaccine recovery to continue to support undervalued cyclical value stocks over expensive technology and growth stocks. Further disturbances in the debt markets from short term pockets of inflation may see some turbulence spillover in equity markets, however low longer-term inflation and central bank support should limit this risk. Trade tensions between the U.S. and China (and Australia by association) may also present as a key risk.