How to Create a Resilient Retirement Strategy

Posted on 27/6/2025

Private Wealth

Overview:

One of the greatest concerns for retirees is the risk of outliving their savings. While disciplined saving and investing during your working years lays the foundation for retirement, the way you manage and allocate those assets once you retire is just as critical. A thoughtful retirement strategy for distributing your wealth can make all the difference in ensuring long-term financial security and peace of mind.

Retirement should be a time of freedom and fulfillment, not financial stress. Yet one of the most common concerns among retirees is the fear of outliving their savings. While accumulating wealth during your working years is crucial, how you manage and allocate those assets in retirement is equally important, hence the essensial for a solid and resilient retirement strategy.

If you have substantial capital, you may be able to take on more investment risk with a longer-term focus. However, if you need to draw more income than your portfolio generates through interest and dividends, you’ll gradually need to dip into your capital – making a lower-risk approach more appropriate.

This is where sequencing risk becomes critical. Experiencing poor investment returns early in retirement can significantly reduce how long your savings last. Conversely, strong returns in the early years can greatly improve your financial longevity. But building enough capital is only part of the challenge. The key is structuring your investments to provide reliable income while allowing your long-term assets the time they need to grow. Selling growth assets during downturns can erode wealth quickly, especially if done out of fear.

At Perks, we advocate a structured, three-tiered investment strategy designed to provide reliable income, manage risk, and support long-term financial wellbeing throughout retirement.

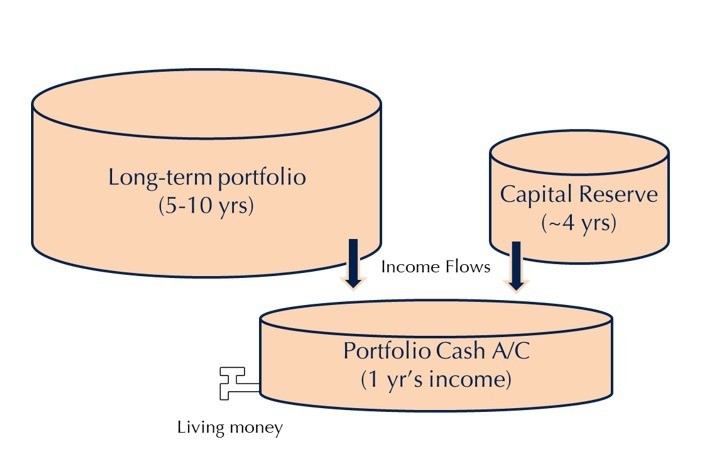

Understanding the Three-Tier Retirement Portfolio

This approach divides your retirement capital into three distinct tiers, each serving a specific purpose:

Tier 1: Short Term Liquidity (Portfolio Cash)

This tier covers your immediate spending needs—typically the next 12 months. Funds are held in liquid cash within a portfolio account, ensuring regular income flows into your daily living account, much like a monthly salary. This buffer helps you avoid selling long-term investments during market downturns.

Tier 2: Medium-Term Reserves

This tier acts as a reliable top-up reserve for replenishing your Tier 1 cash. It should hold at least four years’ worth of income top-ups, ensuring your long-term investments remain untouched for at least five years (1 year in cash + 4 years in reserves). This buffer gives growth assets time to recover from market downturns, allowing you to sell them at more favorable prices and avoid emotionally driven decisions.

These reserves should be invested in capital-stable assets such as term deposits, bonds, and interest-bearing securities, investments that tend to hold their value over shorter periods while generating modest returns to help offset inflation. Their primary role is capital reliability, not high returns.

When your cash buffer runs low, draw from these reserves to top it up. Then, during strong market periods, replenish your reserves to maintain the structure and discipline of your retirement strategy.

Tier 3: Long-term Growth

Invest the remainder of your capital with a long-term horizon, typically five years or more, into growth-oriented assets such as shares, property, and infrastructure. These investments have historically delivered higher returns over time, though they can experience short-term volatility.

Growth assets are essential for most retirees, as they not only help grow your capital but also generate income, both of which are key to sustaining your wealth throughout retirement. Depending on your risk tolerance and market conditions, this tier may also include some cash or fixed interest investments to balance risk and return.

Why The 3-tier Approach Works

The three-tier strategy helps mitigate sequencing risk – the danger of poor investment returns early in retirement, which can significantly impact how long your savings last. By structuring your portfolio to weather market ups and downs, you gain the confidence to stay invested and avoid panic selling.

Moreover, having reserves in Tier 2 allows you to take advantage of market dips by strategically adding to your long-term investments when prices are low, a move that requires courage, but can be highly rewarding.

Tailored to Your Needs

The allocation across tiers depends on your total retirement capital, annual living expenses, and risk tolerance. With guidance from your Perks adviser, your portfolio can be customised to suit your lifestyle and financial goals, ensuring you remain on track throughout retirement.