Guiding Investment Principles

in the midst of a Crisis

Safeguarding your wealth in the face of uncertainty

The world of investments operates like the world in general - a series of events based on cause and effect. In times of unforeseeable crisis, like devastating bushfires or a global pandemic, it is important - in both life and investments - to focus on what can be controlled.

Control what you canThe past week has been a volatile period for global markets in the face of significant drop in oil prices and ongoing economic uncertainty surrounding the coronavirus outbreak. While there has been much commentary from economists and media about the short- and long-term implications of both events, the reality is that these kind of global events are highly unpredictable and there’s no silver bullet to right the ship or crystal ball that we can look in to tell us what the future holds. For those with exposure in equity markets, times like these highlight the importance of perspective and taking a calm and considered approach before making any significant financial commitments. It is easy to feel out of control both mentally, emotionally and financially when the devastating impacts of a natural disaster or a pandemic affect your community, livelihood and even the larger financial markets. At times like these, it’s important to remind ourselves of what we can control. |

As the Scouts say, Be PreparedIn the world of private wealth, the best of us plan our investments to weather unpredictable market disruptions, such as a natural disaster or the coronavirus. The volatility that we are currently seeing in global equity markets, highlights the importance of taking a planned and considered approach to investing. A sound investment strategy should always consider:

For example, for us at Perks Private Wealth, we structure, manage and monitor our clients’ portfolios, prioritising performance in an area that we can control. For us and for our clients, our guiding investment principles provide peace of mind:

All of our clients’ portfolios are structured to cope with market volatility. While it is difficult to predict how long this volatility will last or when markets will show signs of recovery, we continue to monitor global events and we are always prepared to manage the risk that arises from these scenarios. |

Staying across the economic environmentCoronavirus and its impacts The spread of coronavirus (COVID-19) beyond China has resulted in an elevated response level from governments and health agencies across the world and the realisation of significant long-term impacts on global economies has driven sharp market volatility. What is important to remember is that this is not the first time that global markets have been faced with a similar situation. While each virus is different and it is not possible to predict the trajectory of COVID-19 or the subsequent market reaction, history shows that the market will bounce back. For example, SARS in 2003 and swine flu in 2009 both resulted in market corrections in the 5-15% range, which were followed by sharp rebounds as cases began to decline. While there is no doubt that the outbreak of COVID-19 is having a significant impact on industries such as travel, hospitality and manufacturing and causing significant disruption to global supply chains, Central Banks and governments across the world are already stepping in to help alleviate some of the impacts. In fact, just last week, the Australian Federal Government announced a $17.6 billion economic stimulus package, which includes tax relief for small businesses, one-off cash payments for welfare recipients and money to help keep apprentices in work. It is hoped that through economic stimulus and better management of the virus by global, federal and state health authorities that the impacts will reduce over time and markets will return to normal.

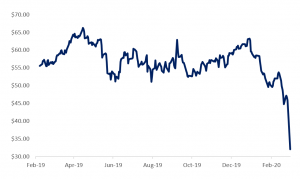

OPEC fails to reach oil agreement If the coronavirus wasn’t enough, the recent meeting of world’s oil producing nations (OPEC) failed to result in a renewed agreement with Russia on further oil production cuts to support stability in the global oil price. While investors were holding out for a positive outcome, negotiations between Russia and Saudi Arabia – two of the key players – broke down over agreement on production cuts and pricing, with Saudi Arabia launching a price war that has resulted in the crash that has seen Brent oil prices halve from USD$64 per barrel to $USD32 per barrel as demonstrated in the chart below. Brent oil prices (Image source: Bloomberg) While this is good news for motorists at the bowser, this will result in lower income for oil producing nations with emerging market producers at the greatest risk and there will likely be a spill-over effect in the commodities sector. Lower oil prices could also see companies such as Woodside Petroleum, Santos, Oil Search and Beach Petroleum put on hold or shelve new projects if they are unable to meet their break-even price per barrel over the medium-term.

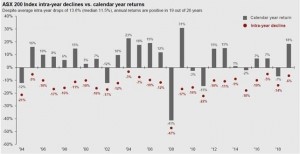

Impacts on the Australian Market The effect on the Australian Market is that we are likely to see earnings outlook downgrades across several sectors, which is likely to result in further short-term volatility as the virus continues to evolve. Defensive sectors such as healthcare, consumer staples and infrastructure (sub-sectors) should be relatively less impacted by these events; however, resources (energy, iron ore and copper), tourism/travel and consumer discretionary sectors are likely to be more heavily impacted. The important thing to keep in mind is that panic is not the best course of action. Market volatility is a natural occurrence and something we’re no stranger to. Importantly, historical data shows that short-term corrections result in longer-term bounce backs, which is consistent with market data back as far as 1900. Significantly – and more recently – as the above graph shows, where there has been a decline during the year (intra-year), markets tend to produce positive returns over time with 19 of the past 26 years returning a net positive result. This demonstrates that volatility is normal and sell-offs are common, and those who ride the short-term pain will realise longer-term gain. |

4. Stay close to international politicsGiven Trump’s preoccupation with equity market returns, asset prices could be boosted in the run-up to the 2020 US Presidential election in November. Also, global central banks (including the RBA) are expected to remain supportive and short-term interest rates will likely continue falling, supporting equity valuations. However, it is important to remember that the level of forecast returns for stocks today is still relatively low, especially when compared to the history of the past decade’s bull asset market. |

5. Measure your expectationsLow yields and constrained GDP growth indicate that it is not reasonable to expect the double-digit returns we saw last year, let alone high single-digit returns. Invest for the long term and focus on a long-term plan that suits your wealth, age & risk tolerance. As most investors knows, diversification is a key to insulating yourself against risk and providing yourself with the greatest opportunity for growth. In a low-growth market, you should aim for a portfolio that contains a range of different yield producing investments. This can include a mixture of equities, bonds and alternative investments such as real assets including unlisted property or infrastructure. Get your financial adviser to break down your options and risks. Getting the right investment advice can make all the difference in planning for your financial future, achieving your financial goals and maximising your private wealth potential.

Perks Private Wealth advice and services are provided by Perks Private Wealth ABN 086 643 058, Australian Financial Services Licence No. 236 551. This document contains general advice and has been prepared without taking your personal circumstances into account. You should consider the appropriateness of it in light of your own personal circumstances. You should obtain and read the PDS and seek advice if necessary before acquiring any financial product. Please refer to our Compliance & Legal page for PPW’s FSG for contact information and information about remuneration and associations with product issuers. This information, including any assumptions and conclusions, is not intended to be a comprehensive statement of relevant practice or law that is often complex and can change. To the extent permitted by law, no liability is accepted for any loss or damage as a result of any reliance on this information. |

Read our Private Wealth Insights

2024-25 Federal Budget Summary

15/5/2024

Tax

On May 14, 2024, Treasurer Jim Chalmers presented the Australian Federal Budget for 2024-25. This budget aims...

Read more.

The Charts that Matter | Investment Update | April 2024

18/4/2024

Private Wealth

Simon Hele recently spoke with Christo Hall to discuss our Investment Committee's key thoughts on the current...

Read more.

Perks Welcomes New Directors to its Group Board

8/1/2024

Original Article: September 2023

We welcome two new members to the Perks Group Board and look forward to them making a...

Read more.

I want to stay across private wealth insights

[contact-form-7 id=”3476″ title=”Contact form LP2019″]